The Australian Economy – Inflation

The devastating war in Ukraine will have a huge impact on people living in both Ukraine and Russia for many years to come and we, like most around the world, are hoping for a quick resolution with the least lives lost. The impact of this war in Australia economically is expected to be low, but certainly adds to global uncertainty and further supply side issues worldwide for both raw materials such as wheat (both Ukraine and Russia are in the top 5 largest exporters of wheat worldwide) and of course oil and gas from Russia.

The uncertainty we have seen from the War coupled with stronger than expected CPI data, points toward the likelihood of higher than expected interest rates in the US, and is weighing heavily on equity markets globally. Inflation is high in many western countries as these economies recover from years of COVID interruption and are fuelled by record low interest rates and government benefits and their central banks grappling with the path to normalisation of policy. Australia is no different, with inflation data suggesting interest rate rises are on the near horizon with the RBA’s final signal to move, wage growth, pointing to sooner rather than later for the first rise.

The supply chain disruptions and cost increases across the property sector has widely added to uncertainty and whilst Payton has no underlying exposure to any of the recent developer collapses, it’s something we are monitoring very closely with each developer who has an active construction site with us. It is prudent to remember that the insolvency that we have seen, and may see in the property industry, is not a result of today’s operations but rather the last 12 months.

When assessing new lending opportunities, we are specifically looking at how the developers and builders are factoring in cost escalation of materials and trades, and increased contingency to ensure an appropriate buffer if conditions do in fact remain or worsen.

What Have We Seen?

Unemployment

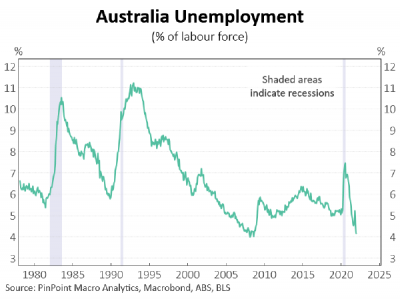

The labour market has once again tightened in the latest print from the Australian Bureau of Statistics (March 2022) with unemployment reducing to 4% which is the lowest print we have seen in 13 years. Whilst we are still adjusting to living with COVID, we can thankfully say that most restrictions are largely behind us and most CBD office, hospitality, tourism, and entertainment finally seeing workers and customers return with confidence.

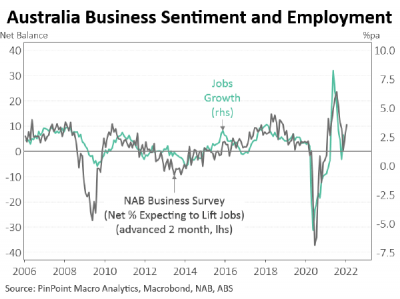

The flow through of this confidence in both the business sector and consumer sentiment has led to some of the toughest competition we have seen in the hiring market for some time. With the shortage of incoming skilled and seasonal workers, there is pressure across all industries for workers and thus we are hearing evidence of much stronger wage growth which we expect to flow through to official numbers due in May 2022.

Economic Growth

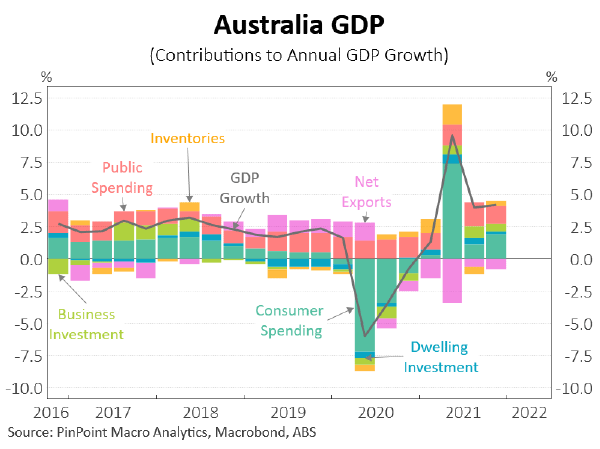

The latest GDP print has once again surprised economists with a swing from negative, primarily due to the lockdowns across NSW, VIC and the ACT, back to an increase of 3.4% in Q4 2021. The biggest contributor was a surge in household spending of 6.3% in Q4. Consumers coming out of lockdowns finally had the chance to spend some of the war-chest of savings that we have seen and there is still much room for improvements in spending.

The CBA estimates (March 2022) that Australians have saved an astonishing $265Bn over the COVID period which we look forward to seeing deployed once consumers have confidence around the finality of restrictions and feel safe enough to venture out and spend again. With the final border, WA, opening we have seen Interstate travel resume to multi year highs and whilst international borders are open, we expect that many Australians will stay within the country for some time to come.

Where Are We Now?

Cash Rate

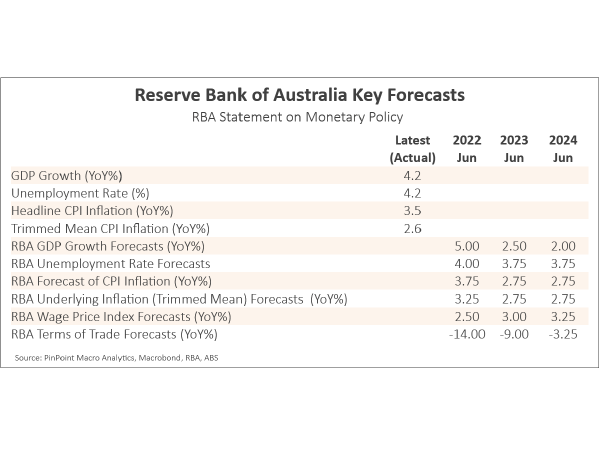

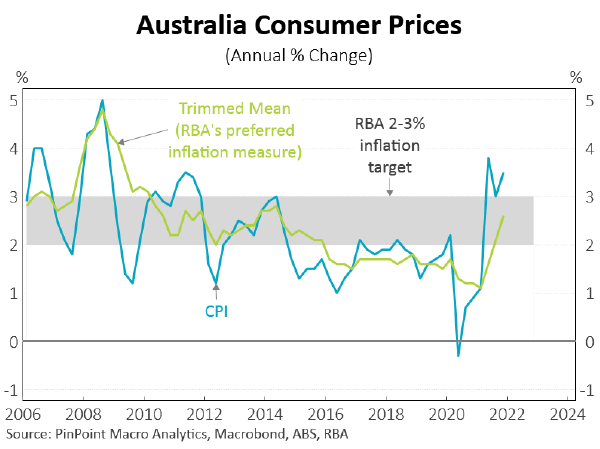

Interest rates remain as the key indicator that investors are watching as we stare into the impact of rising interest rates on property and the broader economy. The RBA maintains that they will begin normalising the cash rate (increasing rates) when they feel that inflation is sustainably in the target range. Whilst we are seeing higher than expected inflation data and strong employment data, the RBA is unlikely to change their longer-term call until they can see that inflation will remain above the 2-3% band through 2023 and 2024 which they currently predict will remain at 2.75%.

Rising interest rates are not necessarily a bad thing if the policy is carried out in an orderly manner which we believe that the RBA will be very careful to do, balancing both the need to control inflation and fostering a strong economy.

opening of the country both domestically and internationally. The CBA most recent forecast (28/8/2021) outlines a rate rise in 2023 to which they expect the first rate rise to be 15bp followed by steady increases of 25bp across 2023/24. Low rates coupled with expectations that future rises are some time off, should help to maintain the pre-lockdown confidence in property markets seen throughout Australia’s capital cities.

Savings

The household saving ratio once again delivered a very strong result at 13.6% in the December quarter 2021. This is slightly off from the mammoth print of 19.8% in September quarter 2021 but continues to demonstrate the level of savings Australians are accumulating and have the ability to deploy. We have previously noted the unprecedented amount of household savings that has continued to grow.

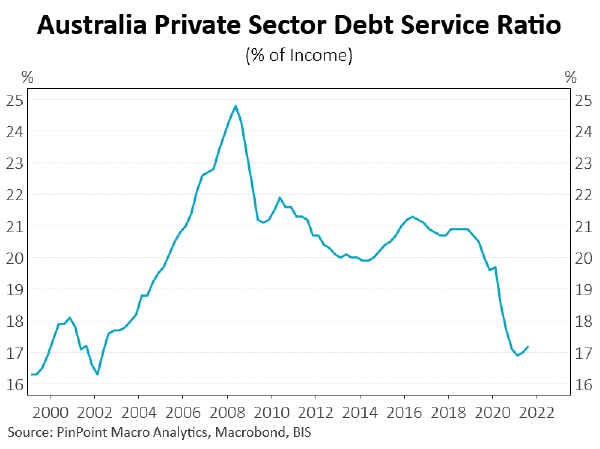

As the level of savings has grown through the pandemic, people have also been working on reducing their debt which has seen a significant reduction in the private sector Debt Service Ratio from circa 21% in 2019 to a low of circa 17% in late 2021. The reduction in the Debt Service Ratio is very pleasing to see given the rapid growth in house prices as an indicator that rising interest rates can be absorbed by home loan holders without impacting household finances significantly.

We also note that APRA on the 6 October 2021 changed the interest rate buffer it requires lenders to incorporate into their lending assessment increasing it by half a percent, further ensuring that home lending funded today can be afforded by borrowers as interest rates rise. For context, the rate a home loan may be assessed at typically for a borrower today is 7.5% p.a interest rate vs the rate the borrower is likely to pay for this debt being around 3%.

What Do We See?

Property Prices

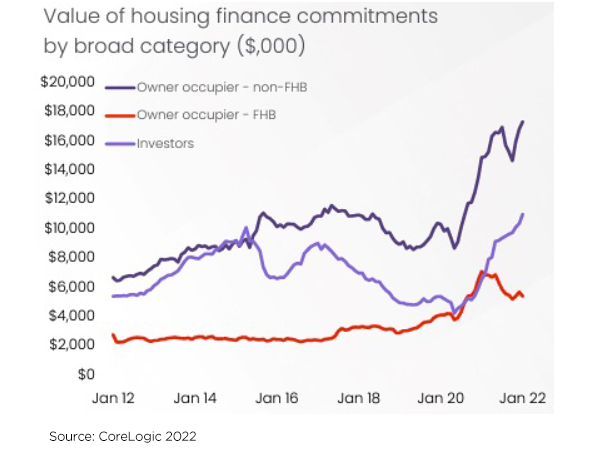

According to CoreLogic (March 2022) after the most sustained run of growth in home values in 30 years, we are starting to see cooling conditions across most capital cities and regional markets. This phenomenal price growth has been helped by government incentives such as Homebuilder grant for new homes and record low interest rates for the established market. The market is starting to contemplate the effect of rising interest rates and its effect on price with many sellers seeing the market slow and rushing to list their home to catch the tail end of this price run. We expect to see this result in a slew of homes on market and a quick self-fulfilling prophecy as vendors need to adjust expectations to achieve a sale.

The big four banks have already kicked off an increase in home loan interest rates via a move in their fixed rates. While we expect the RBA will do much of the heavy lifting in raising mortgage rates through this and next year, we do expect the major banks will move with and in some cases more than the RBA rates on the variable side and continue to move the fixed rates up as their funding costs increase. The CBA estimates (February 2022) that there is around $500Bn of fixed rate mortgages due to expire in the next two years, most of which will reset to higher rates and in turn help to achieve a natural tightening in lending demand.

Australia’s biggest Bank, the CBA, predicts (February 2022) that we will see a national decline of up to 10% in dwelling prices across 2022. We agree with this thesis in pockets of the market, but also expect to see a much stronger demand from investors who may look to reduce their exposure to risk assets such as equities and return to ‘safer’ assets such as Australian residential property. As such apartments and select investor locations may in fact continue to deliver growth as other segments plateau.

Inflation

The December 2021 quarter delivered the expected increase in CPI that market analysts expected which confirm that the economy is roaring pack post COVID and is on track to force the RBA’s hand in raising interest rates.

The +3.5% increase in GDP over the December 2021 quarter was the strongest quarterly increase in GPD since the March quarter 1976. At the 9 March AFR Business Summit , Governor Lowe said “the recent lift in inflation has brought us closer to the point where inflation is sustainably in the target range. So too have recent global developments. But we are not yet at that point.

In underlying terms, inflation has just reached the midpoint of the target band for the first time in over seven years.” Whilst this indicates that the RBA is not convinced yet that inflation will indeed remain in the target band, we firmly believe that with a very strong wages print expected in May 2022 and the decade low unemployment, the RBA will be forced to increase rates within the June quarter 2022

Craig Schloeffel | Head of Investment | craig.schloeffel@payton.com.au

Disclaimer: The information contained in this document is of a general nature and does not take into consideration the investment objectives, financial circumstances or needs of any particular recipient – it contains general information only. The views expressed in this document are solely those of the author and are subject to change without notice.

Any financial projection and other statements of anticipated future performance that are included in this document are for illustrative purposes only and are based on assumptions that are subject to risks and uncertainties and may prove to be incomplete or inaccurate. Actual results achieved may vary from the projections and the variations may be material.

Before deciding to make an investment with Payton, you should carefully read all of the information in the relevant Fund Information Memorandum, and consult with your business adviser, financial planner, accountant or tax adviser. Reliance upon information in this document is at the sole discretion of the reader. Payton Capital Ltd is an authorised representative of Payton Funds Management Pty Ltd ABN 32 107 613 258 AFSL 284280

About the author / Craig Schloeffel

~~ Related Posts ~~

Payton Capital Quarterly Economic Update March 2024

By Craig Schloeffel|2024-03-28T17:00:25+11:00March 28, 2024|

Payton Capital Quarterly Economic Update December 2023

By Craig Schloeffel|2023-12-15T12:16:58+11:00December 15, 2023|

Media Release: Payton Capital’s Queensland Expansion

By Jodie Elg|2024-01-25T11:28:11+11:00October 20, 2023|

Payton Capital Quarterly Economic Update September 2023

By Craig Schloeffel|2023-09-28T16:51:27+10:00September 28, 2023|

Payton Capital announce Chief Risk Officer Appointment

By David Payton|2023-10-20T14:46:25+11:00September 25, 2023|

Australia’s Housing Crisis is on the Verge of Imploding

By David Payton|2023-08-17T15:47:33+10:00July 4, 2023|

Payton Capital Economic Update June 2023

By Craig Schloeffel|2023-07-03T14:19:54+10:00June 30, 2023|

Foresight Analytics Upgrades Payton Capital’s Operational Due Diligence

By Jodie Elg|2023-09-19T17:41:20+10:00June 12, 2023|

Payton Capital Economic Update March 2023

By Craig Schloeffel|2023-07-04T14:40:08+10:00March 23, 2023|

Economic Update December 2022

By Craig Schloeffel|2023-08-18T14:01:07+10:00December 12, 2022|

Economic Update September 2022

By Jodie Elg|2023-09-18T18:39:37+10:00September 6, 2022|

Foresight Analytics rates Payton Capital Funds as STRONG

By Jodie Elg|2023-08-17T16:46:59+10:00June 17, 2022|