Payton Capital Economic Update June 2023

Executive Summary:

The present economic climate is a mixed bag, as contrasting factors pull the economy in different directions. On one hand, there are notable challenges that warrant attention. Consumer confidence is experiencing a decline, reflecting a cautious outlook among individuals and households. Furthermore, inflationary pressures persist, contributing to higher prices and eroding purchasing power. To compound matters, interest rates show a persistent upward trend, creating additional hurdles for businesses and consumers alike.

The present economic climate is a mixed bag, as contrasting factors pull the economy in different directions. On one hand, there are notable challenges that warrant attention. Consumer confidence is experiencing a decline, reflecting a cautious outlook among individuals and households. Furthermore, inflationary pressures persist, contributing to higher prices and eroding purchasing power. To compound matters, interest rates show a persistent upward trend, creating additional hurdles for businesses and consumers alike.

However, amidst these headwinds, there are also promising factors that offer some respite. One such positive influence is the impact of migration. The influx of new residents brings fresh labour and entrepreneurial talent to the economy, stimulating growth and innovation. This injection of human capital can help to relieve areas of labour shortage and associated pressure on wage growth, contribute to productivity gains and drive economic expansion.

Moreover, the residential property market emerges as a clear winner amid this complex economic landscape. Rising house prices, coupled with an under-supply in the property market, fuel this sector’s growth. Despite the challenges faced in other areas, the property market demonstrates resilience and continued demand, making it an attractive investment opportunity. Investors should however tread cautiously whilst the market adjusts to changing demographic trends, (eg increased percentage of long term renters), and affordability constraints are tested and proven.

What have we seen?

Consumers

The powerhouse of the Australian economy is household consumption, and until recently, it seemed invincible. The slings and arrows of RBA rate hikes bounced off as spending roared ever onward. However, consumption is beginning to show signs it is mortal – and the enormous gap between consumer confidence and consumer behaviour is starting to close.

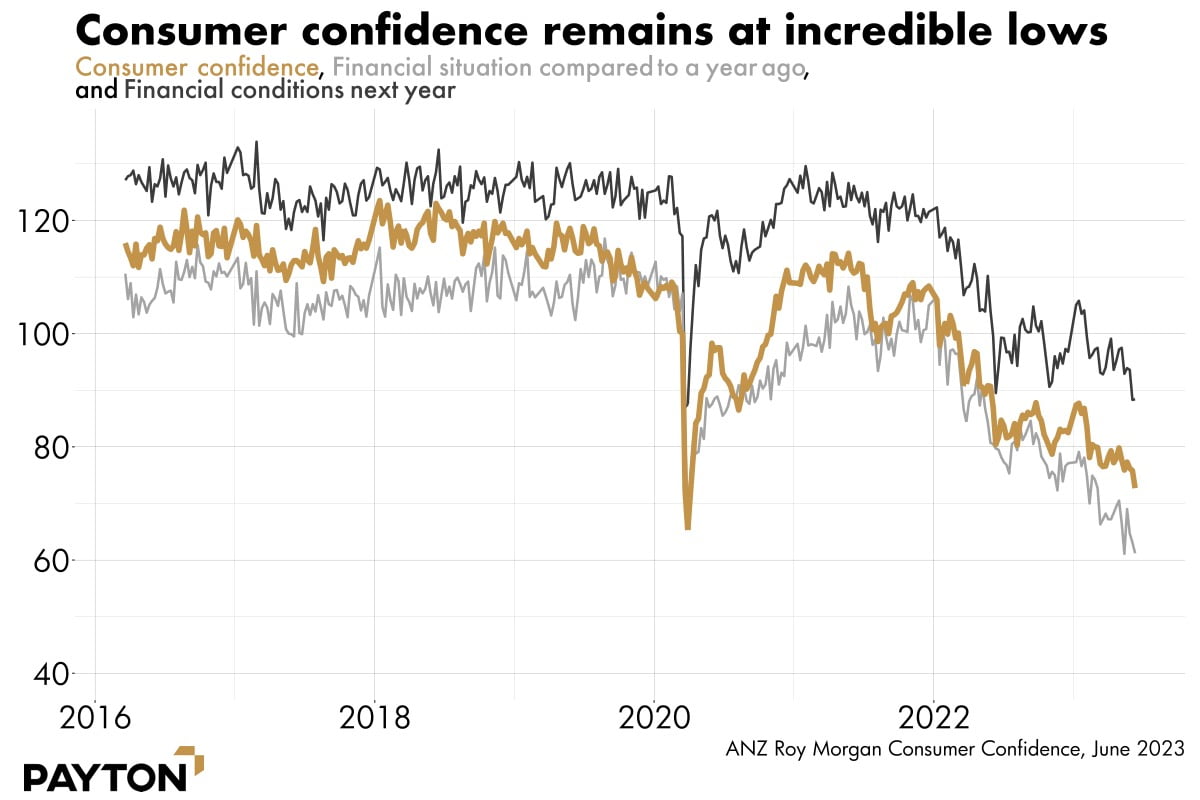

It is hard to overstate just how bad consumer confidence looks. The historical average for consumer confidence is 111.4. In June 2023 the ANZ Roy Morgan consumer confidence gauge recorded confidence at just 72.7. That is an extreme low. Consumer confidence is compiled by measuring a number of subcomponents, and the worst of them all is consumer assessments of their financial situation compared to a year ago as you can see in the following chart in pale grey. Consumer assessments of financial conditions over the next 12 months are much higher, as the darker grey line shows.

Assessment of current financial conditions is being driven down by rising interest rates. The lift in official rates from near zero in early 2022 to over 4 per cent now is the fastest on record. As homeowners come to grips with higher loan repayments or are forced to refinance their loans, they lose confidence.

The gap between the dark grey (future) and pale grey (current) lines is usually significant. It points to the perpetual optimism among Australians – think of it as hope things can’t be this bad forever. Right now the gap is particularly high, indeed nearly as high as it was in the depths of the pandemic. That’s a sign people are finding the present time unusually hard.

Consumer spending remains solid, however the significant gap between consumer intention and actions reported in previous updates is receding. No longer are consumers crying disaster while spending in abundance at cafes and restaurants. Instead, discretionary spending is down in the most recent data, while it is essentials spending that has risen.

Household budgets are finally tightening, it seems, with the expected flow-on effect to consumer-facing businesses. Previous falls in consumer confidence presaged this, and so the more recent, even deeper falls in consumer confidence may point to even bigger cuts in household spending to come. The period between March and September this year is when the flow on effect from the ultra-low fixed-rate mortgages of circa 2 to 3 per cent will expire, and when we will see these borrowers revert to today’s higher rates which for some will be a big jump.

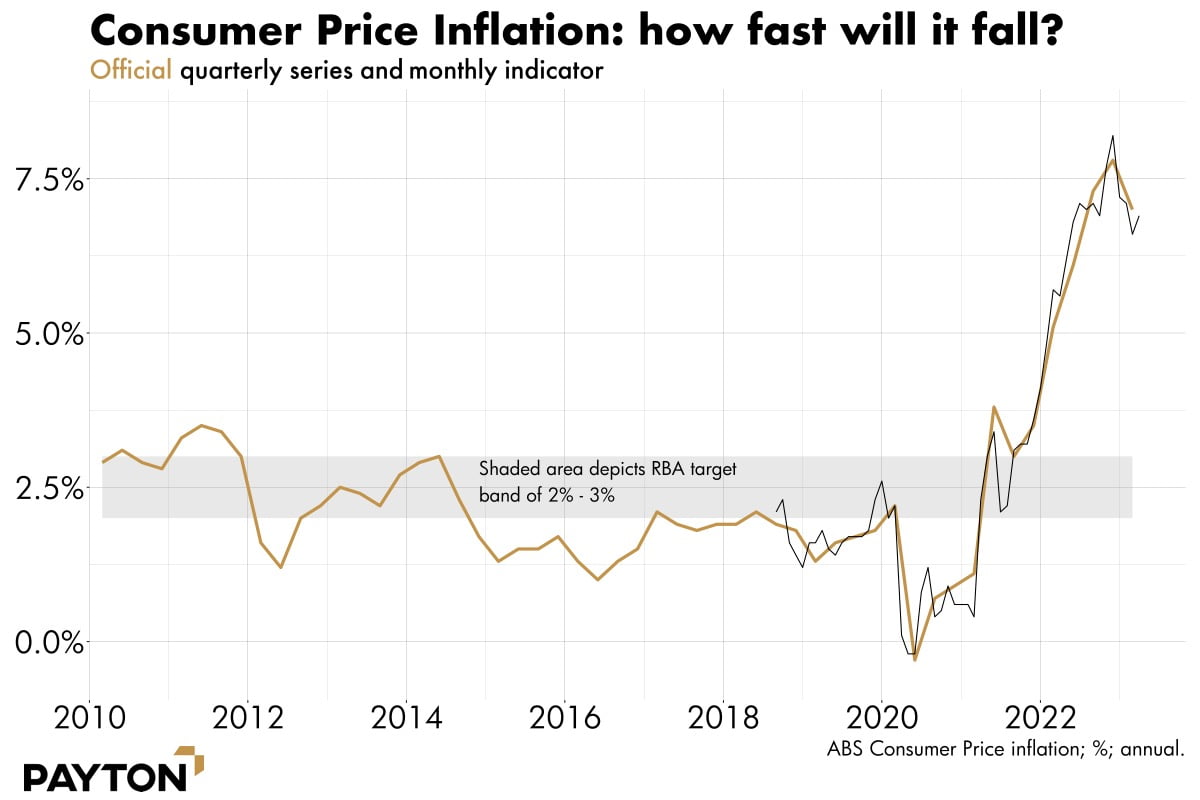

That should make it harder for businesses to raise prices, which is the ultimate goal of monetary policy. That’s how inflation is defeated. For now, inflation has fallen, but not yet tumbled, as the next chart shows. The speed with which it retreats will determine how long contractionary monetary policy remains in place.

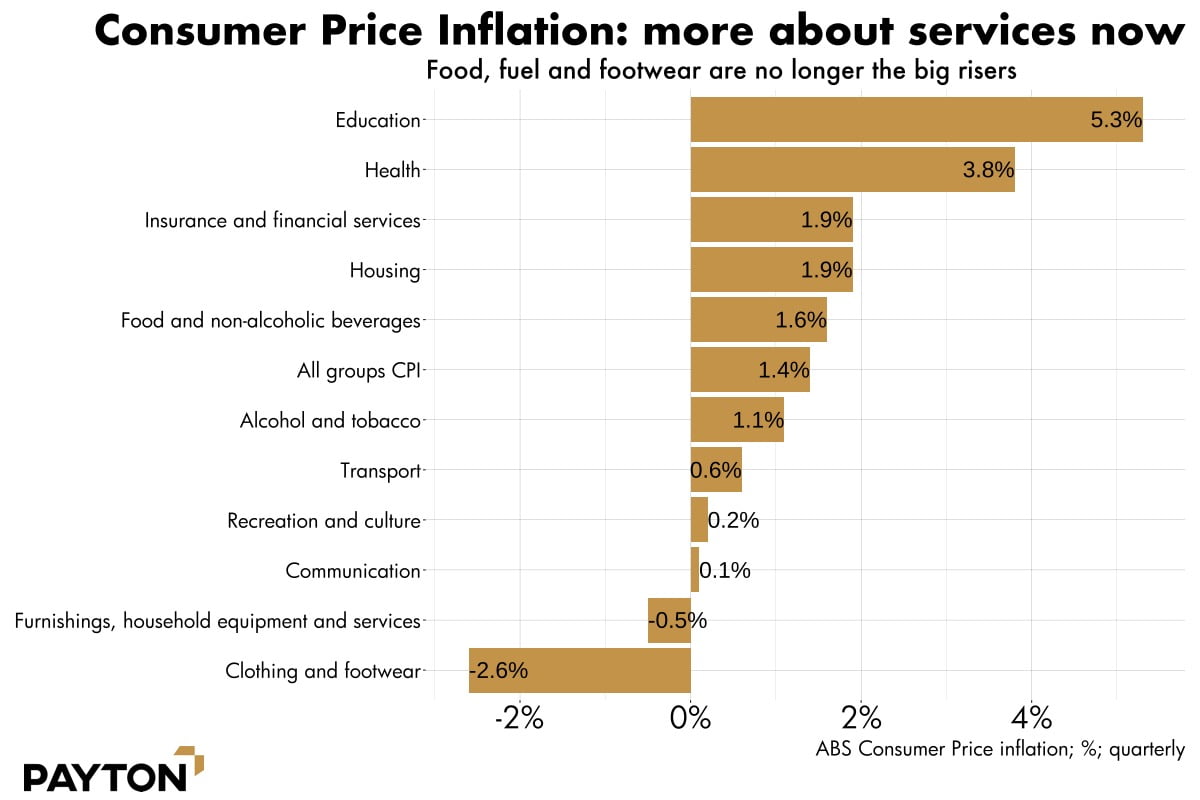

The nature of inflation is beginning to change in Australia. Price pressures are no longer largely imported, but rising in domestic services, as the next chart shows. This heralds a shift from potentially transitory inflation to potentially dangerous inflation which is built into consumer expectations and requires still higher interest rates to shift. This is only likely to happen if we continue to see inflation across essential services like education, health and insurances as these services can’t be avoided.

Services are a labour-intensive sector, and the shift from goods inflation to services inflation hints at rising wage inflation. If high wages inflation folds back into goods inflation and creates a feedback loop, then the RBA has its work cut out for it. That is an outcome we want to avoid but also don’t see as a central case. The very tight jobs market will have added a lot of pressure on wages in these critical industries and as immigration and an expected loosening within the jobs market comes, we expect to see some relief here.

The next chart shows that rising rates are the outcome the market predicts. Futures markets predict rising rates until late 2023, then a more gradual fall as the RBA reverses course.

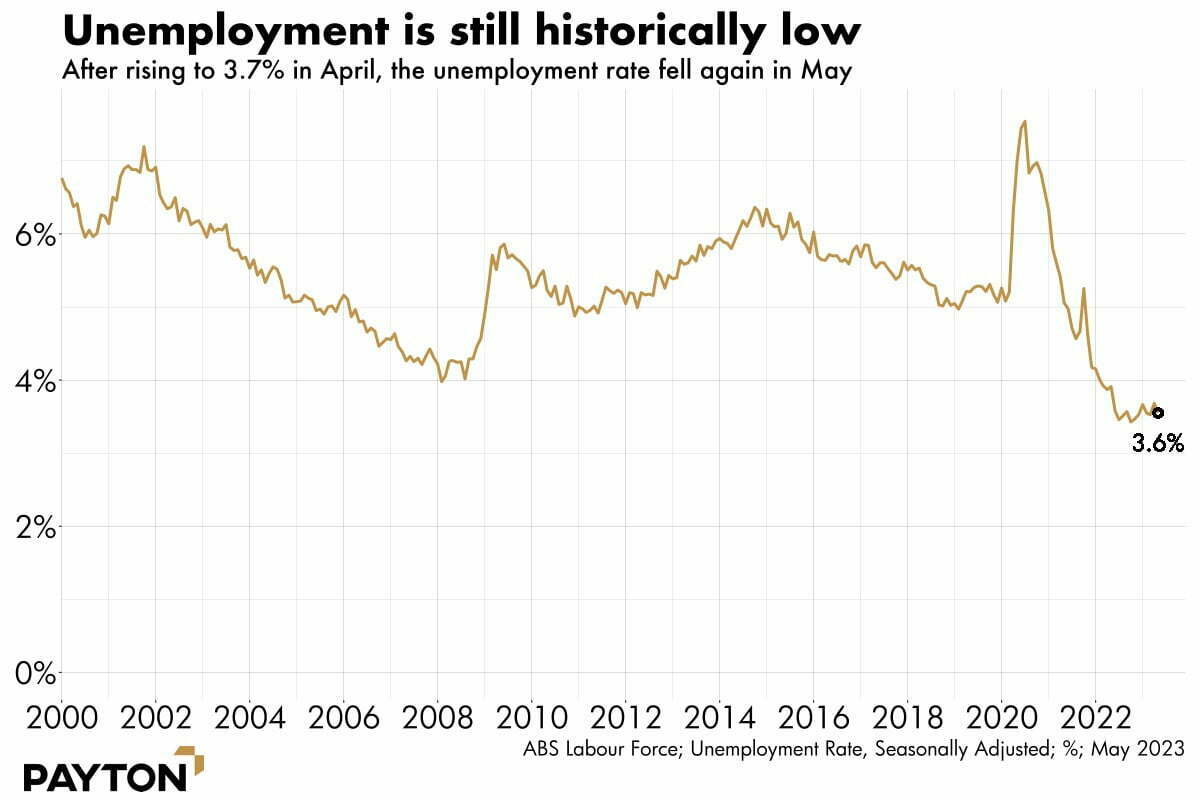

Unemployment

For now, Australia’s labour market remains in extremely good shape as you can see on the next chart. The unemployment rate fell for the period between April to May, despite rising labour force participation. That’s impressive, because we need strong jobs growth just to absorb population growth right now. The labour market added enough jobs in May (61,700 full time workers and 14,300 part time workers, seasonally adjusted) to not only absorb the unprecedented numbers of people moving to Australia but also absorb existing jobseekers.

The state of the labour market leaves in play the possibility of the most benign outcome – inflation is defeated while the unemployment rate does not spike. Unfortunately, it also leaves in play the possibility that the RBA is forced to hike more than expected, we get on top of inflation later than we hoped, and more collateral damage is wrought. Certainly interest rate futures are higher now, with rates to level at between 4.35 percent and 4.6 per cent in 2023. This would mean one or two more rate rises to come this calendar year which the major banks agree with, having lifted their rates forecasts.

Still, the signals from abroad are promising. US inflation has fallen to 4 per cent annual in the most recent data, with prices rising just 0.1 per cent in May. Of course, while we followed the US on the way up, it doesn’t mean we follow them on the way down. Domestically ingrained inflation could diverge from US experience if inflation expectations diverge, and especially if wages rise.

Where are we now?

Productivity and Wages

The recent minimum wage decision is pertinent in that regard. The Fair Work Commission locked in a 8.6 per cent wage rise for Australia’s lowest paid, applying from the first pay period after 1 July 2023. While less than 1 per cent of Australian workers make minimum wage, the Fair Work Commission also increased award wages by 5.75 per cent. Those wages apply to 20.5 percent of the workforce in number of people. But because these workers tend to be entry level, part time or casual, they make just 11 per cent of all wages paid (in dollar terms) in the Australian economy. Nevertheless it sets a precedent for stronger wage expectations across the board as employers head into end of year wage rise discussions.

The wage price index has recently climbed to 3.7 per cent, well below inflation. That gave hope that a wage price spiral was not in effect. The risk is that the rest of the employment market match these rises, thus pushing up the index above 3.7 per cent.

Falling real wages are bad news, of course. The idea is that in the period of high inflation, falling real wages help reduce inflation, and then later, when inflation is defeated, real wages rise again.

Rising wages will be non-inflationary if productivity also rises. Higher pay can contribute to growth and keep inflation down if every hour worked creates more output. Higher labour productivity can be achieved by giving workers more training or more capital (equipment, computer software, etc) that allows them to do more, or by arranging business processes more efficiently.

In recent times, productivity has been going the wrong way. The national accounts record a fall in productivity of 4.5 per cent over the last year, the largest on record. Before we panic, it is important to note that lower productivity can be a side effect of lower unemployment. The last few people hired are usually the least productive ones. So our strong labour market performance may explain some of our low productivity performance. Nevertheless this needs to reverse if Australia is to get real wages back on track and become a richer country.

What do we see?

Migration

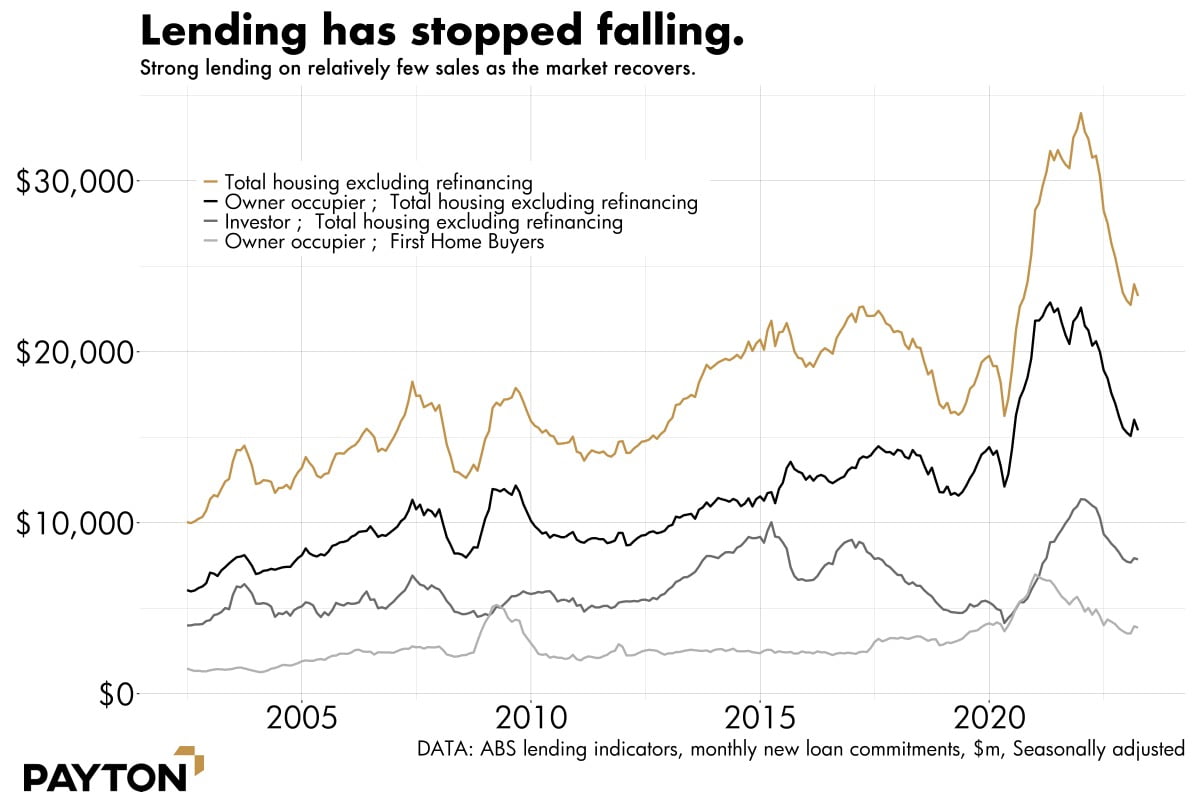

Despite the economic turbulence, the housing market in Australia remains strong. The market sits at the intersection of the supply and demand for credit and supply and demand for the underlying asset. At the moment, the latter dominates. Rental vacancies are so few and migration so strong that homes are in hot demand.

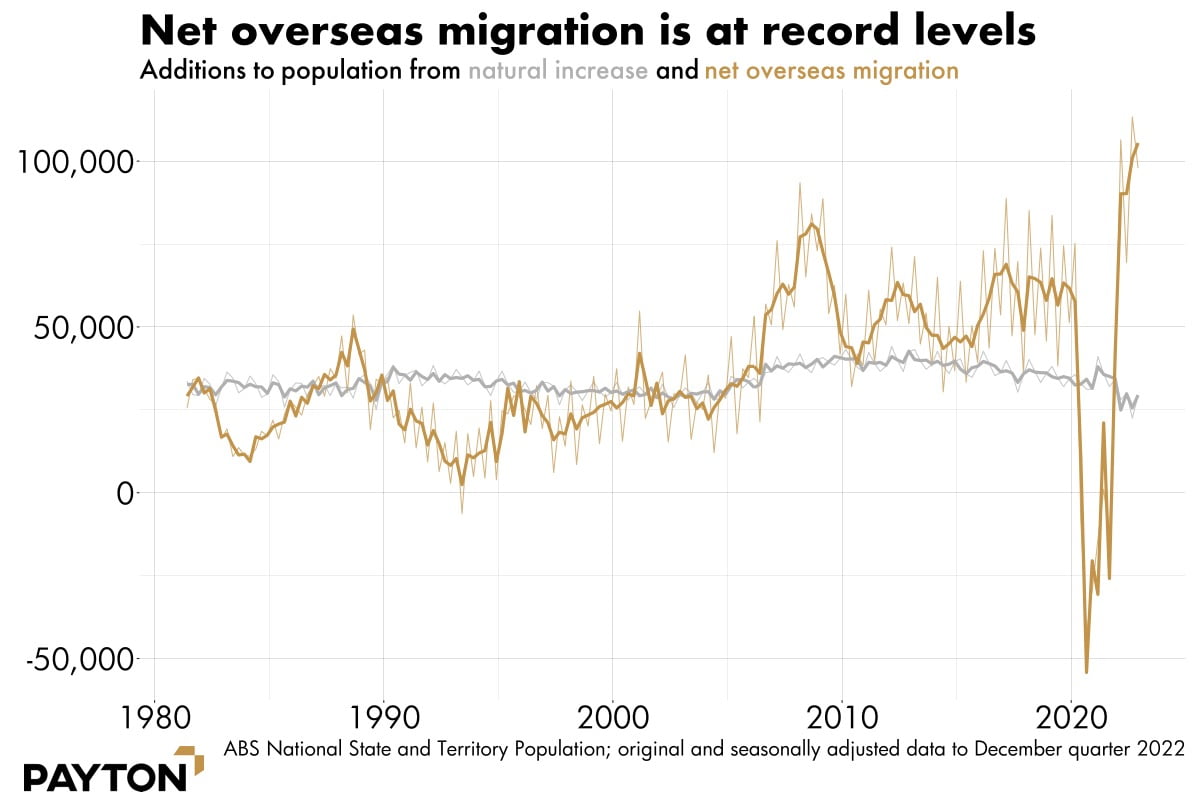

As the next chart shows, net overseas migration is averaging about 100,000 per quarter in recent times, which is a record. That follows a record low during the pandemic. Whether you consider playing catch-up in this fashion to be appropriate may depend on whether you’ve been waiting for your visa to be approved, or whether you’re applying for a rental property on Australia’s eastern seaboard.

The high rate of population growth is responsible for much of Australia’s recent economic growth. Without population growth, the economy would have gone backwards, with the recent national accounts confirming that in per capita terms, the economy has shrunk. Per capita economic growth was -0.2 per cent in the first three months of 2023.

House Prices

Despite that, house prices are rising, as the next chart shows. In the three months to May 2023, house prices in Sydney rose 4.5 per cent, while price falls were confined to the smaller capitals.

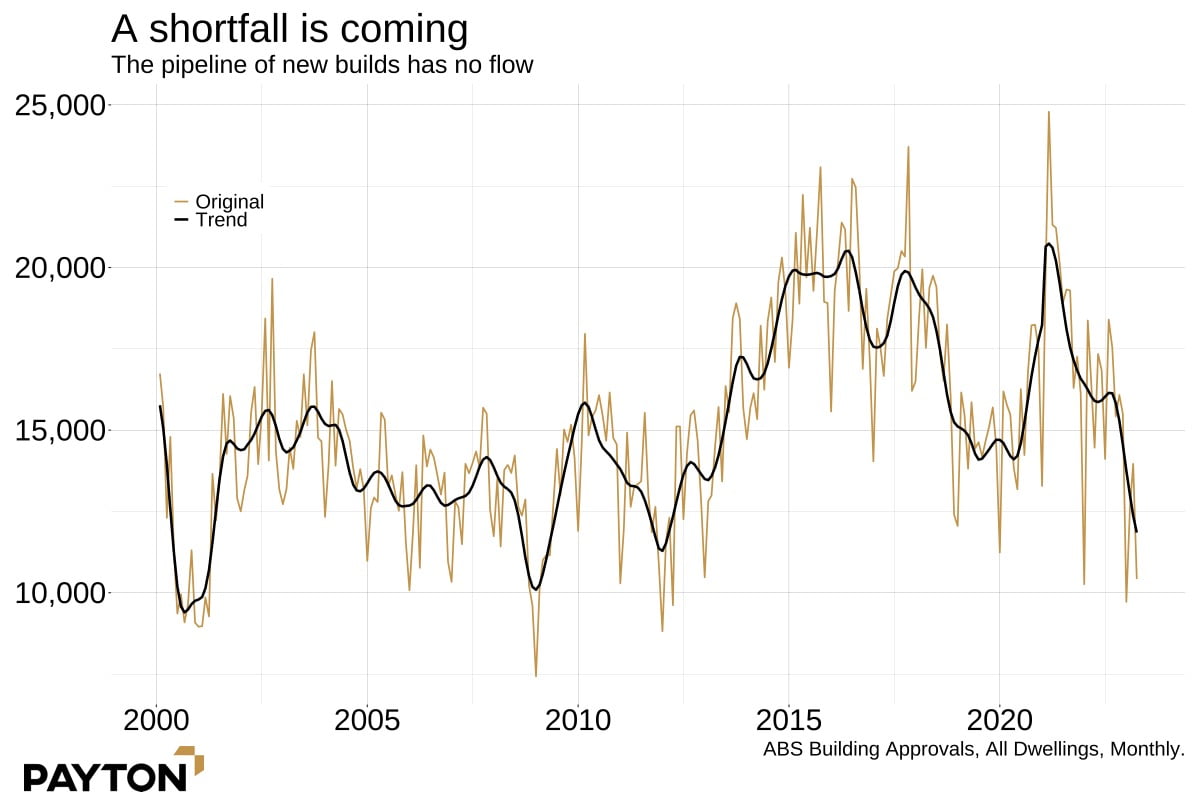

A shortage of supply in the market is meeting the upswing in demand, creating a perfect storm of rising prices. That shortage of supply is locked in for some time, as the pipeline of new builds dries up. Not only are fewer new homes being finished, but fewer are being started too. Building approvals have fallen dramatically, as the next chart shows. Without approvals, no building can start and without new buildings, the intensity over housing will only increase. This creates an opportunity for investors in the property space to capitalise.

Conclusion

The current state of the Australian economy presents a fascinating and somewhat perplexing scenario. Mixed data and conflicting indicators make it evident that we stand at a crucial juncture. While the possibility of a technical recession looms, it is important to acknowledge the resilience displayed by the residential property market. Amidst the challenges faced by other sectors, the property market continues to provide a refuge for investors seeking stability in a volatile environment. For those of us investing in and lending to the Australian residential property sector, as we navigate these uncharted waters, it becomes increasingly vital to closely monitor local market trends and conditions and to adopt a cautious yet strategic approach to ensure sustainable growth.

Disclaimer: The information contained in this document is of a general nature and does not take into consideration the investment objectives, financial circumstances or needs of any particular recipient – it contains general information only. The views expressed in this document are solely those of the author and are subject to change without notice. Any financial projection and other statements of anticipated future performance that are included in this document are for illustrative purposes only and are based on assumptions that are subject to risks and uncertainties and may prove to be incomplete or inaccurate. Actual results achieved may vary from the projections and the variations may be material. Before deciding to make an investment with Payton, you should carefully read all of the information in the relevant Fund Information Memorandum, and consult with your business adviser, financial planner, accountant or tax adviser. Reliance upon information in this document is at the sole discretion of the reader. Payton Capital Ltd is an authorised representative of Payton Funds Management Pty Ltd ABN 32 107 613 258 AFSL 284280

About the author / Craig Schloeffel

~~ Related Posts ~~

Payton Capital Quarterly Economic Update March 2024

By Craig Schloeffel|2024-03-28T17:00:25+11:00March 28, 2024|

Payton Capital Quarterly Economic Update December 2023

By Craig Schloeffel|2023-12-15T12:16:58+11:00December 15, 2023|

Media Release: Payton Capital’s Queensland Expansion

By Jodie Elg|2024-01-25T11:28:11+11:00October 20, 2023|

Payton Capital Quarterly Economic Update September 2023

By Craig Schloeffel|2023-09-28T16:51:27+10:00September 28, 2023|

Payton Capital announce Chief Risk Officer Appointment

By David Payton|2023-10-20T14:46:25+11:00September 25, 2023|

Australia’s Housing Crisis is on the Verge of Imploding

By David Payton|2023-08-17T15:47:33+10:00July 4, 2023|

Payton Capital Economic Update June 2023

By Craig Schloeffel|2023-07-03T14:19:54+10:00June 30, 2023|

Foresight Analytics Upgrades Payton Capital’s Operational Due Diligence

By Jodie Elg|2023-09-19T17:41:20+10:00June 12, 2023|

Payton Capital Economic Update March 2023

By Craig Schloeffel|2023-07-04T14:40:08+10:00March 23, 2023|

Economic Update December 2022

By Craig Schloeffel|2023-08-18T14:01:07+10:00December 12, 2022|

Economic Update September 2022

By Jodie Elg|2023-09-18T18:39:37+10:00September 6, 2022|

Foresight Analytics rates Payton Capital Funds as STRONG

By Jodie Elg|2023-08-17T16:46:59+10:00June 17, 2022|