Payton Capital Quarterly Economic Update September 2023

Executive Summary:

Residential property is emerging as arguably the safest sector in Australian property markets as rate hike pressure finally abates and while the unemployment rate holds at impressively low levels. Migration is soaring and consumers are beginning to sense some optimism about the future. Interest rates are much higher than consumers have seen for years, but they are finally stable and that is removing a great cloud of fear.

At the same time, inflation appears to be moderating. Rampant price escalation is not being seen, with the exception of a few categories, like rents. Households who have paid off their own home and those who rent face distinctly different economies.

Consumption is the largest single part of the economy and Christmas spending will help determine the rate of growth throughout coming months. A lavish Christmas is unlikely in per capita terms, but we expect to see enough spending to keep the Australian economy growing at a steady level in the final quarter of 2023.

What have we seen?

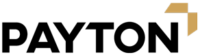

Australian consumers have been battered in the last 12 months since we saw the first interest rate rise in May 2022. Rising prices and high interest rates have left their mark on consumer spending and especially on reported consumer confidence. Finally, the belief that inflation is falling, and interest rates have reached their peak is setting in and contributing to a welcome uptick in consumer confidence, especially about the future.

There can be a lag between rising consumer confidence and rising spending, just as there was a lag on the way down. But the turning point appears to be here, as the next chart shows.

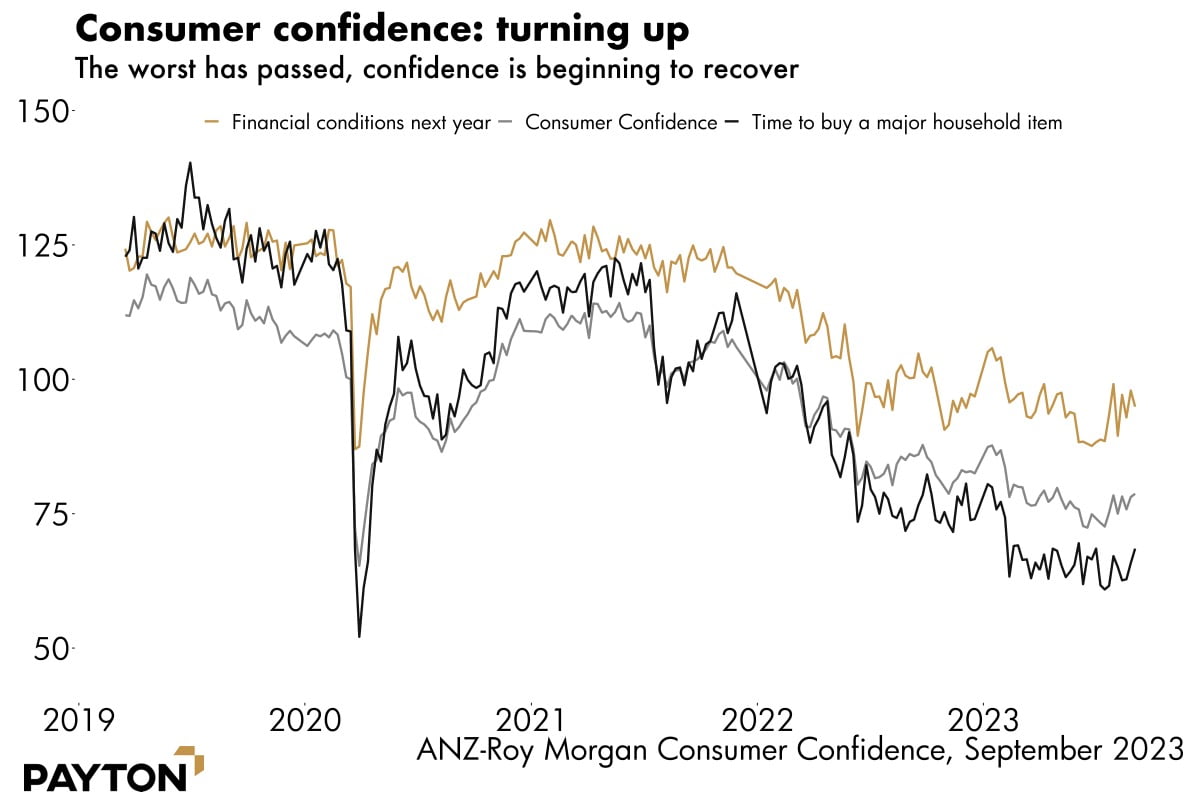

Despite the tightening effect of repeat rate rises, Australian firms have been holding onto workers. Indeed, they have been hiring enough to compensate for the very high levels of population growth Australia has seen in the last few months.

Unemployment remains at the historically low rate of 3.7 per cent, with only a small uptick in the last few months as the nation absorbs the effect of higher rates. A strong labour market is beneficial in many ways as people employed create a large ripple effect as they use their wages across the rest of the economy.

Economists like to use the word “hysteresis” to refer to this effect. People in jobs gain skills, increase productivity and retain employability, while the reverse is also true as people out of work become less employable. The labour market has a certain amount of path dependency; high unemployment is hard to overcome and low unemployment is self-sustaining. Australia is on the more desirable of those two paths.

While the labour market remains remarkably healthy, it would be remiss not to mention the blemishes – not every subcomponent of the data is moving in the positive direction. In the most recent month (August) the vast majority of the new jobs added were part time; hours worked fell, and underemployment (people seeking more hours) rose.

This is a softening around the edges. But from a position of strength. It helps reassure the market that wages are not going to run away. A wage-price spiral is not impossible but looks less likely each day.

Wages growth is in something of a sweet spot; not so low that households are going backwards fast, but not so high that the RBA feels inclined to clamp down on the economy even harder. The most recent wage price index was up 3.6 per cent over the year, and the more up to date Seek Advertised Salary Index shows wages growing at 4.6 per cent.

Recession talk is abating as we continue to post positive growth numbers. Australia’s economy grew 3.4 per cent over the year to June 2023, although in per capita terms, output fell. Output also fell in nominal terms (i.e., not inflation adjusted) thanks to falling export prices. Australia earned less income from exports thanks to weakening global commodity markets, but the majority of the economy is insulated from that effect.

Household consumption was flat in the most recent quarter, with increased spending on essentials compensating for a fall in spending on recreation.

If inflation can return to normal in 2024 without a deterioration in the labour market, Australian households will be in a wonderful position to resume strong consumption growth.

Where are we now?

Nature of inflation

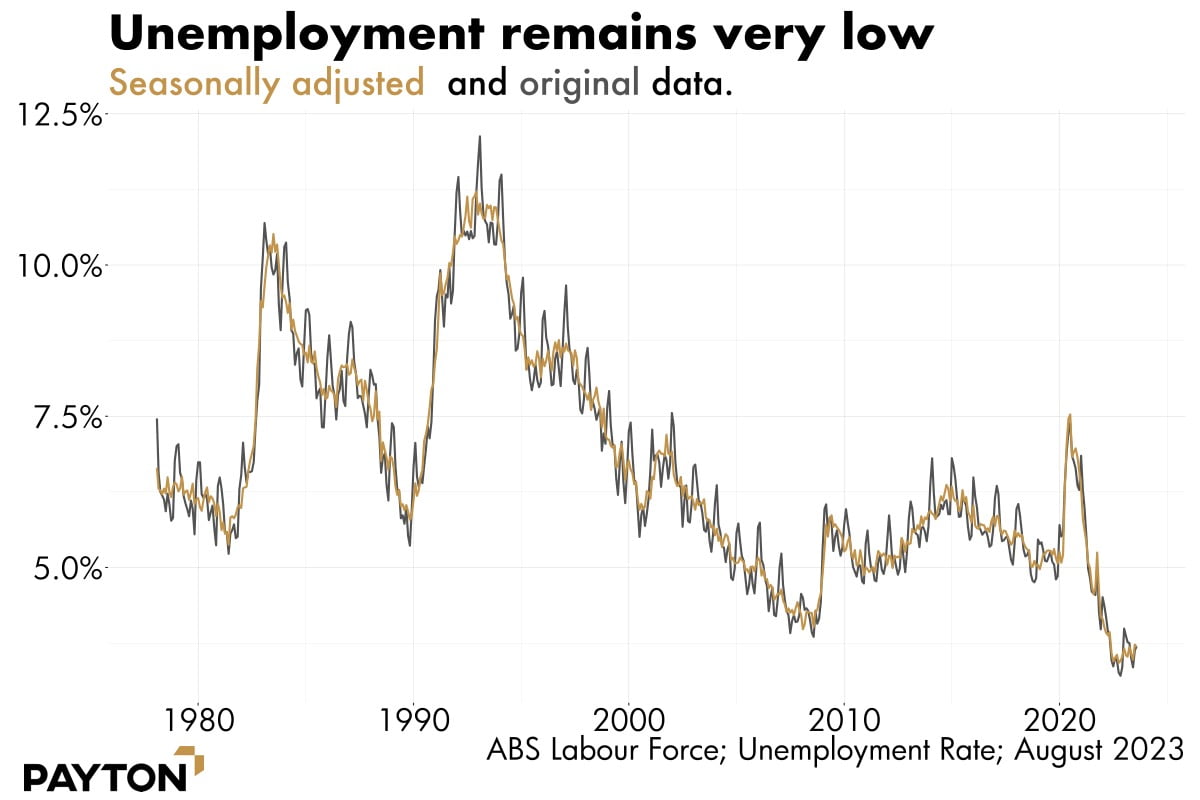

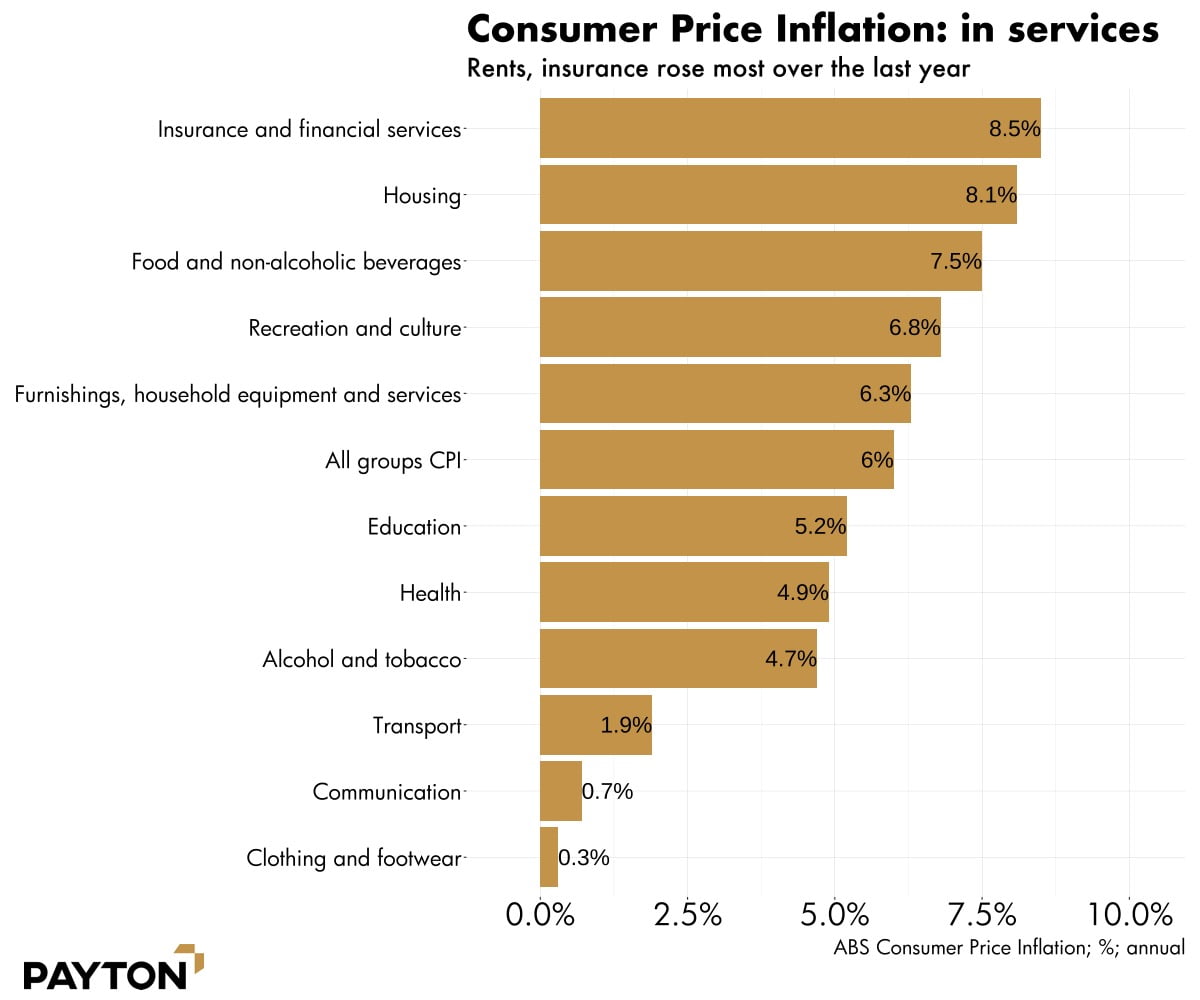

The level of inflation is falling steadily, as the next chart shows. But the process is not as straightforward as it seems; the sources of inflation continue to shift.

We can’t merely extrapolate the fall in consumer price inflation and say it will return to the target band of 2 to 3 per cent. Australian inflation is changeable. At first it presented in imported goods and then it shifted. Inflation in the cost of building a new dwelling was extremely high throughout 2022. Now, some our strongest inflation is in non-discretionary services such as insurance and rents.

Non-discretionary spending is tough to quell. For example, people don’t reduce their consumption of health services when prices rise. There is little chance the RBA can discourage the purchase of insurance, education, and health via rate hikes. Unlike, for example, fancy food from fancy grocers or holiday travel.

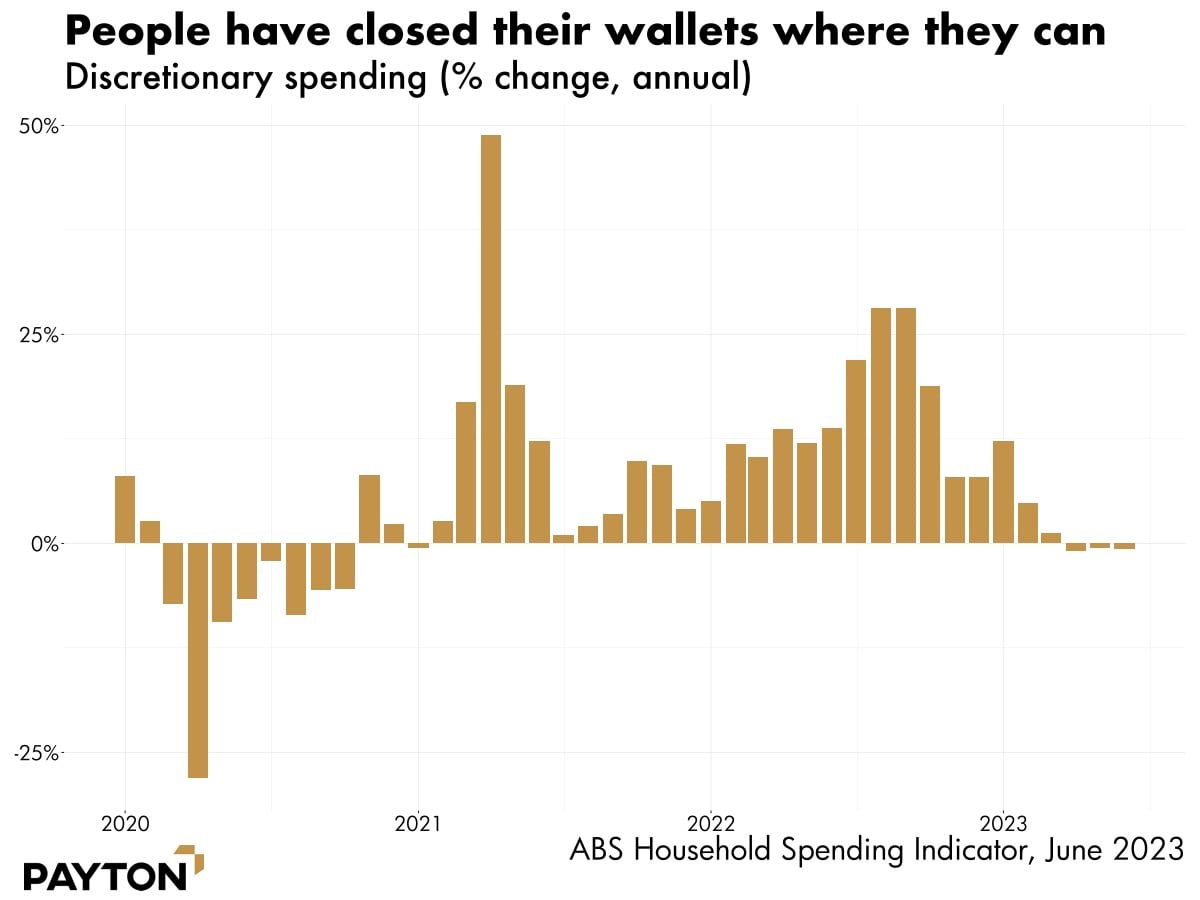

Australians are continuing to spend on non-discretionary items. However, as the next chart shows, spending on discretionary items is lower than a year earlier and has been over recent months.

Consumer prices are growing more slowly overall and the data shows price rises settling in domestic goods rather than imports. What the official CPI data hasn’t caught up to yet is a recent surge in petrol prices. Petrol and diesel are up dramatically, both sitting above $2 a litre. That will lift CPI directly in the month of September, causing the next monthly indicator to rise and the quarterly series to follow when it is released at the end of October.

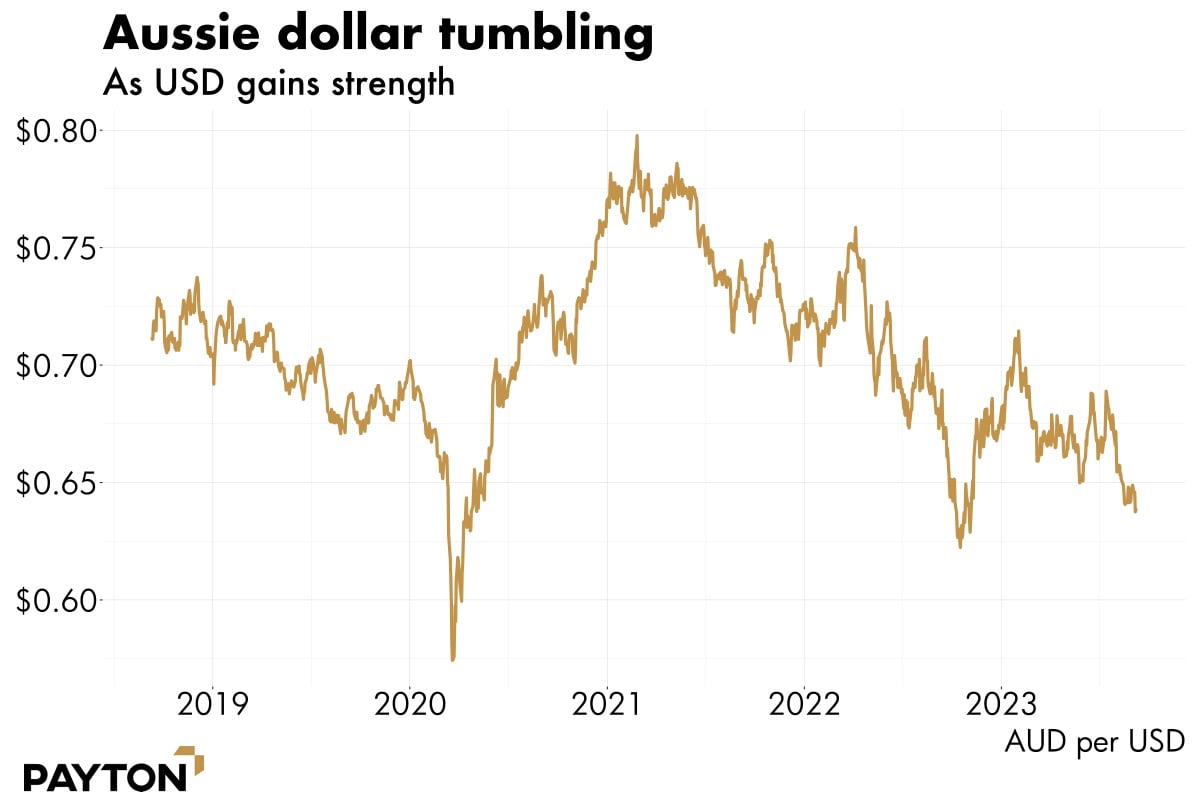

Fuel prices are being lifted by rising prices for crude oil, due to supply shortfalls from Saudi Arabia and Russia. The Australian dollar has also fallen against the USD, as the next chart shows, which can be attributed to falls in the prices of Australia’s big commodity exports.

If recent weakness in the Australian dollar extends or spreads to other currency pairs, it may cause a lift in imported inflation more broadly. Petrol retailers tend to pass on global prices swiftly; other importers will do so in time. If imported inflation rises, price pressure could flow back from domestic services to goods again. That risk is why markets are not betting on rate cuts this year.

CHINA

The situation in China is one to watch. The global growth engine is sputtering, and observers are starting to question if China will be able reach its new lower growth target of 5 per cent this year. Financial excesses in the property space are weighing on Chinese markets. That hasn’t translated into a general panic and financial meltdown, but the future of China is a little more opaque and uncertain than we have become used to.

If Chinese growth falters, the big question will be whether the Chinese Government enact stimulus which could then lift our economy too? Historically Chinese stimulus has been very good for Australia. But can Xi Jinping really engage in yet more steel-hungry building programs when China’s economy is finally choking on its oversupply of real estate? It remains unclear.

On the upside, recent public show of reconciliation between Australia and China is welcome. Trade wars help neither side and the return of Chinese students to Australia helps our economy and universities.

We are also selling coal to China which is positive but not vital. If China stopped purchasing from Australia, they would have to buy from another country. And while Australia would have to find a new home for our supply, there are many other takers on the global market. We sold lots of coal to India when China stopped buying over the last few years. Still, coal is not the only commodity subject to restrictions and there are some product categories where Australia is unable to tap an equivalent market, such as wine. Australian wine and barley could start flowing to China again after the Prime Minister’s trip to China, expected later this year.

What do we see?

Rates

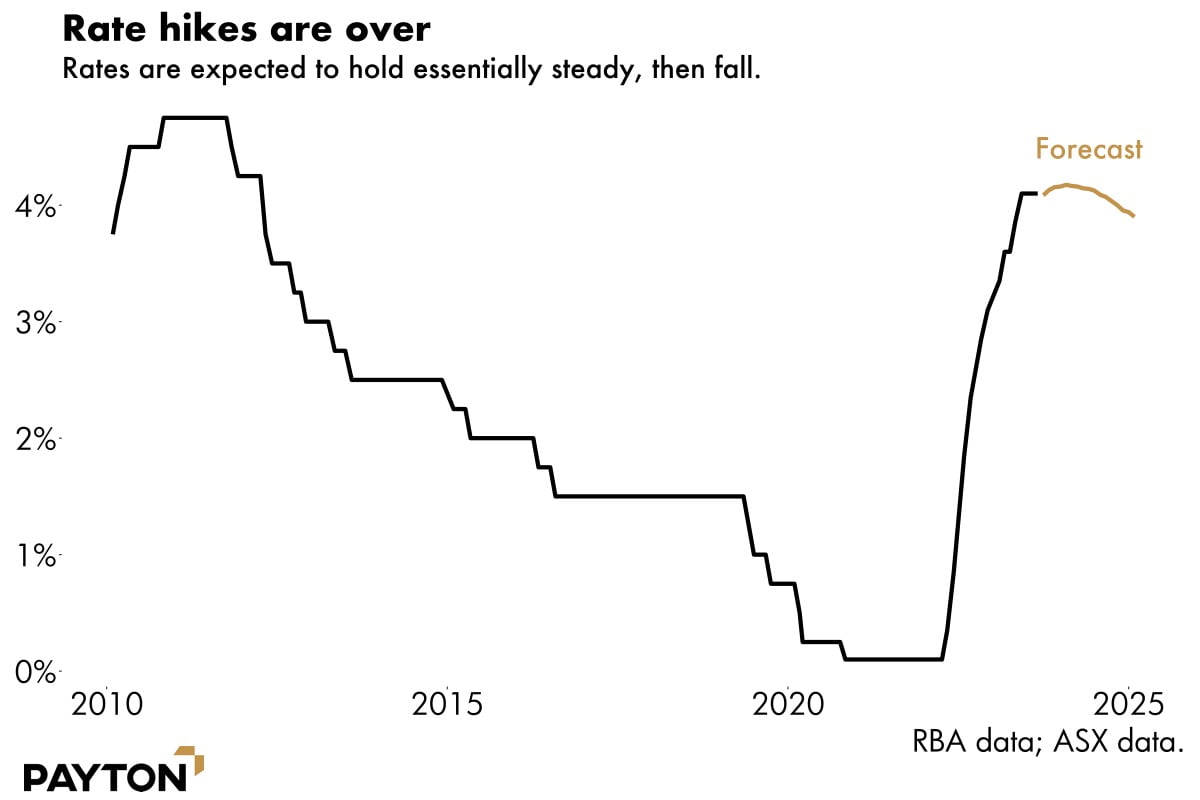

Official interest rates stopped rising in June and have been on hold since. The consensus in futures markets and among RBA-watchers is that the next move is most likely to be a rate cut but not before Christmas, and probably not in the early parts of 2024 either.

Payton predicts a rate cut in early to mid-2024 but the big danger is still in place that we see the wage price index (WPI) stronger than expected or changes in the current spending trend that reverses the downward trend. The most recent data has shown a surprise uptick in CPI but it remains to be seen if this will persist and force the RBA into one more hike.

The new RBA Governor, Michele Bullock, is likely to have a gentle introduction to the role, presiding over as many as ten board meetings before action is needed unless the unexpected happens. Markets expect rates to move next year, and most likely in the second half.

All roads lead to residential property as the economy normalises. Stable interest rates, strong employment, high migration, improving confidence all create an environment where residential property outperforms.

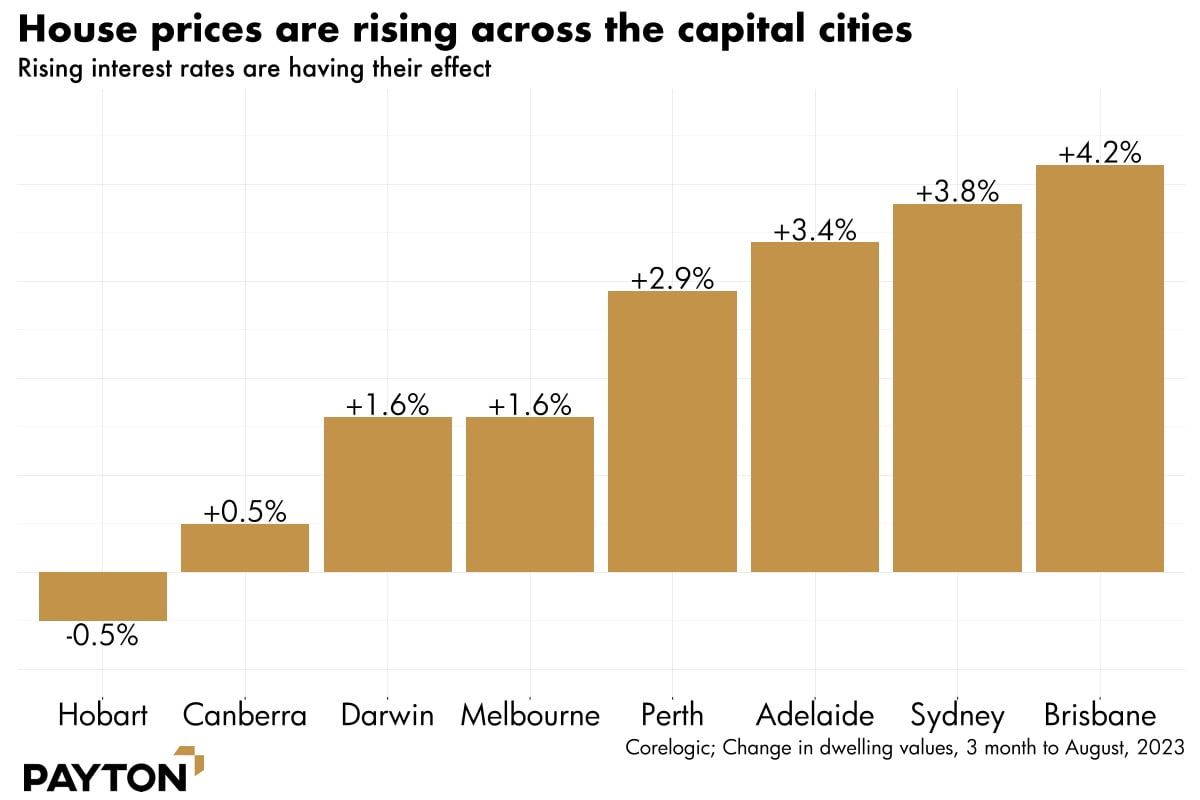

House prices are rising still, albeit not as quickly as they were a few months ago. Auction numbers are rising compared to last year and clearance rates are solid. The market remains underpinned by a distinct supply shortage. High rates of migration are encountering a market with low levels of new builds and a very low rental vacancy rate. Rental vacancies are at record lows of 1.1 per cent nationwide, according to PropTrack data.

The simple maths of supply and demand points to rising prices for residential real estate, even if the same is not true for other sub sectors of the property market like office and retail space.

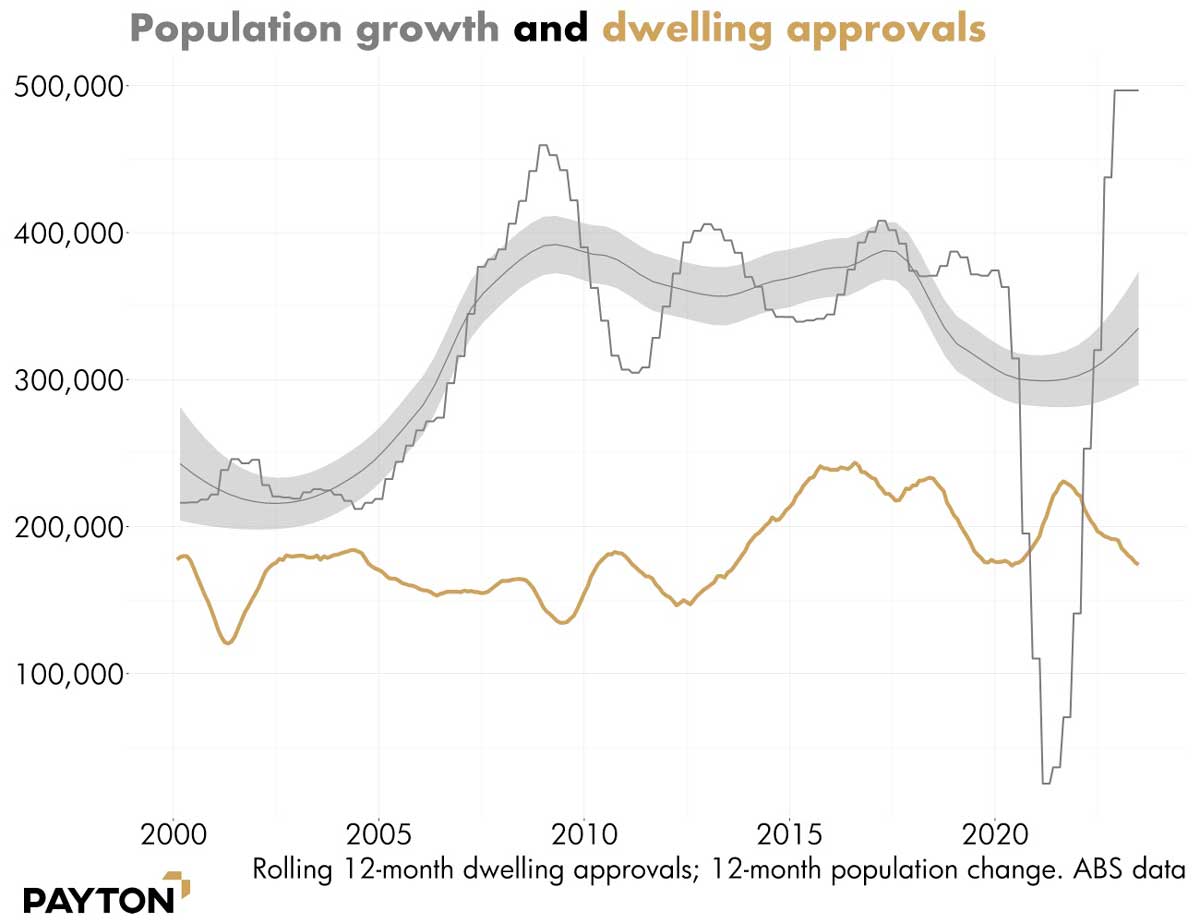

Migration has been running hot. As the next chart shows, population growth compared to a year earlier is at a record high, compensating for the slowdown during covid. However, the building industry is heading in the other direction, with building approvals slumping.

The housing market has two major inputs, demand for homes and demand for credit. Demand for homes is extreme, while demand for credit is being moderated by the cost of borrowing. Existing property investors have been selling their properties to owner-occupiers, exacerbating the shortage of investment properties.

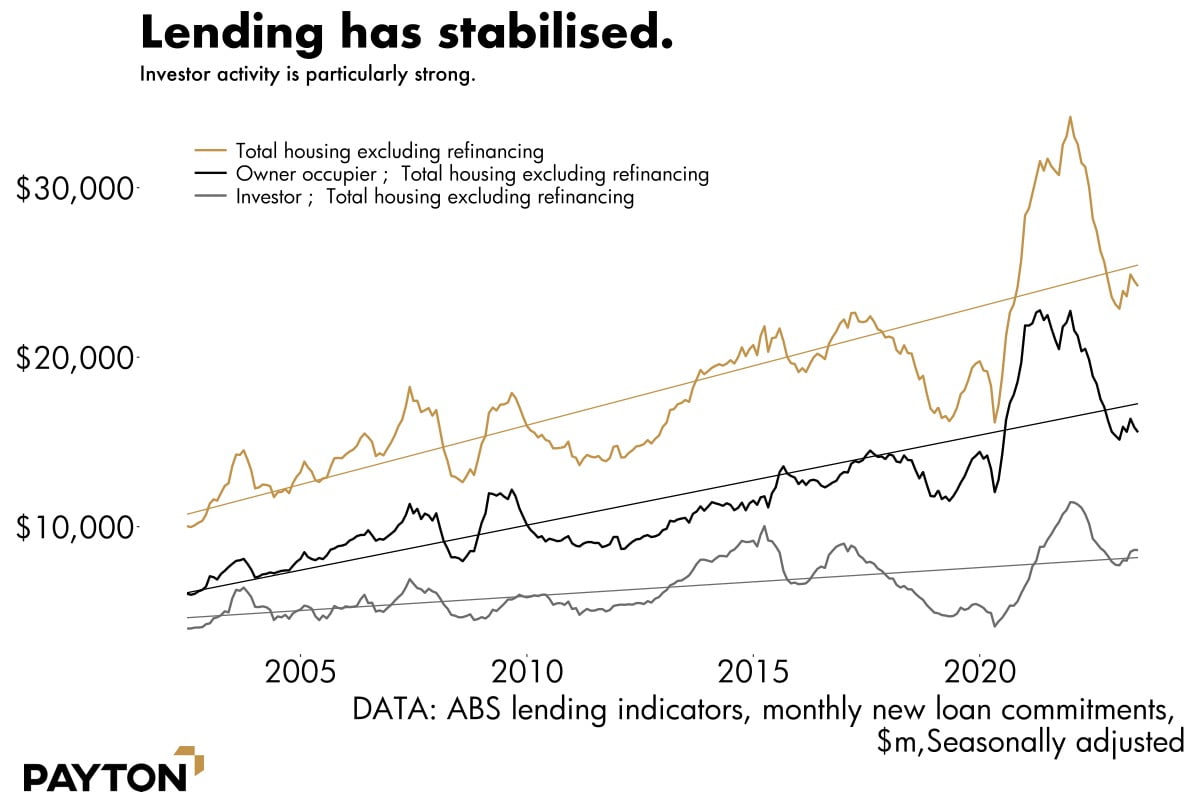

Still, new property investors are buying in, with investors particularly keen to borrow, as the next chart shows.

Investors see a shrinking stock of rental properties, increased yield from rising rents, negative gearing benefits returned with the interest rates rising and a tremendous flow of new Australians. This presents as a key opportunity, and we believe that residential property is likely to be the property class that outperforms in the coming years.

Conclusion

Whilst there is still a lot of moving parts to watch closely across the economic cycle we are in, we firmly believe that the market is pointing to some great opportunity in the residential property market. The building companies underpinning the next wave of growth are starting to see stability of cost and supply in materials, and with the large immigration influx, will hopefully see their labour constrains remedied. All Governments (both state and federal) are now firmly focussed on housing, and this should also see capital flow into the sector via either incentives or cutting of red tape. With over 85% of our book representing some part of the residential property market, we believe that we are well positioned to take advantage of the coming ‘big build’.

Disclaimer: The information contained in this document is of a general nature and does not take into consideration the investment objectives, financial circumstances or needs of any particular recipient – it contains general information only. The views expressed in this document are solely those of the author and are subject to change without notice. Any financial projection and other statements of anticipated future performance that are included in this document are for illustrative purposes only and are based on assumptions that are subject to risks and uncertainties and may prove to be incomplete or inaccurate. Actual results achieved may vary from the projections and the variations may be material. Before deciding to make an investment with Payton, you should carefully read all of the information in the relevant Fund Information Memorandum, and consult with your business adviser, financial planner, accountant or tax adviser. Reliance upon information in this document is at the sole discretion of the reader. Payton Capital Ltd is an authorised representative of Payton Funds Management Pty Ltd ABN 32 107 613 258 AFSL 284280

About the author / Craig Schloeffel

~~ Related Posts ~~

Payton Capital Quarterly Economic Update March 2024

By Craig Schloeffel|2024-03-28T17:00:25+11:00March 28, 2024|

Payton Capital Quarterly Economic Update December 2023

By Craig Schloeffel|2023-12-15T12:16:58+11:00December 15, 2023|

Media Release: Payton Capital’s Queensland Expansion

By Jodie Elg|2024-01-25T11:28:11+11:00October 20, 2023|

Payton Capital Quarterly Economic Update September 2023

By Craig Schloeffel|2023-09-28T16:51:27+10:00September 28, 2023|

Payton Capital announce Chief Risk Officer Appointment

By David Payton|2023-10-20T14:46:25+11:00September 25, 2023|

Australia’s Housing Crisis is on the Verge of Imploding

By David Payton|2023-08-17T15:47:33+10:00July 4, 2023|

Payton Capital Economic Update June 2023

By Craig Schloeffel|2023-07-03T14:19:54+10:00June 30, 2023|

Foresight Analytics Upgrades Payton Capital’s Operational Due Diligence

By Jodie Elg|2023-09-19T17:41:20+10:00June 12, 2023|

Payton Capital Economic Update March 2023

By Craig Schloeffel|2023-07-04T14:40:08+10:00March 23, 2023|

Economic Update December 2022

By Craig Schloeffel|2023-08-18T14:01:07+10:00December 12, 2022|

Economic Update September 2022

By Jodie Elg|2023-09-18T18:39:37+10:00September 6, 2022|

Foresight Analytics rates Payton Capital Funds as STRONG

By Jodie Elg|2023-08-17T16:46:59+10:00June 17, 2022|