Why invest with us?

- Experienced fund manager

- Premium fixed income returns

- Investments secured by mortgages over Australian real estate

- Regular income distributions

- Range of investment terms from 3 months up to 2 years

- Dedicated Relationship Manager

- No cost or fees to invest*

- Low correlation to other asset returns

Available to wholesale, sophisticated and professional investors only.

Our Investment Products– What is Private Debt?

Payton provides an opportunity for investors to access the Australian private debt market, which was traditionally the domain of large scale banks.

To learn more about how private real estate debt works, watch our video.

What is Private Debt?

Payton has been helping to craft wealth and change lives for over 50 years through property-backed investment opportunities.

If you’re looking to diversify your portfolio and searching for an investment that provides regular income returns with capital protection, Payton is the solution for you.

Let’s consider an example:

Jane is a developer who needs capital to fund her next property development. She approaches Payton, her trusted non-bank lender, to apply for a loan. Payton’s team of experts reviews Jane’s loan proposal and undertakes their due diligence on the project. If Payton’s investment committee is satisfied that the development and the loan satisfy its lending criteria, then the loan is approved and secured by a registered mortgage over the property.

Payton then gives its investors the opportunity to invest in the loan and to share in the income from the loan interest payments over the term of the loan, which is typically between 6 and 18 months. Assuming you qualify as a wholesale sophisticated or professional investor, you can apply to become a member of one or both of Payton’s investment funds. When the project is finished, your investment is returned to you to reinvest in another opportunity.

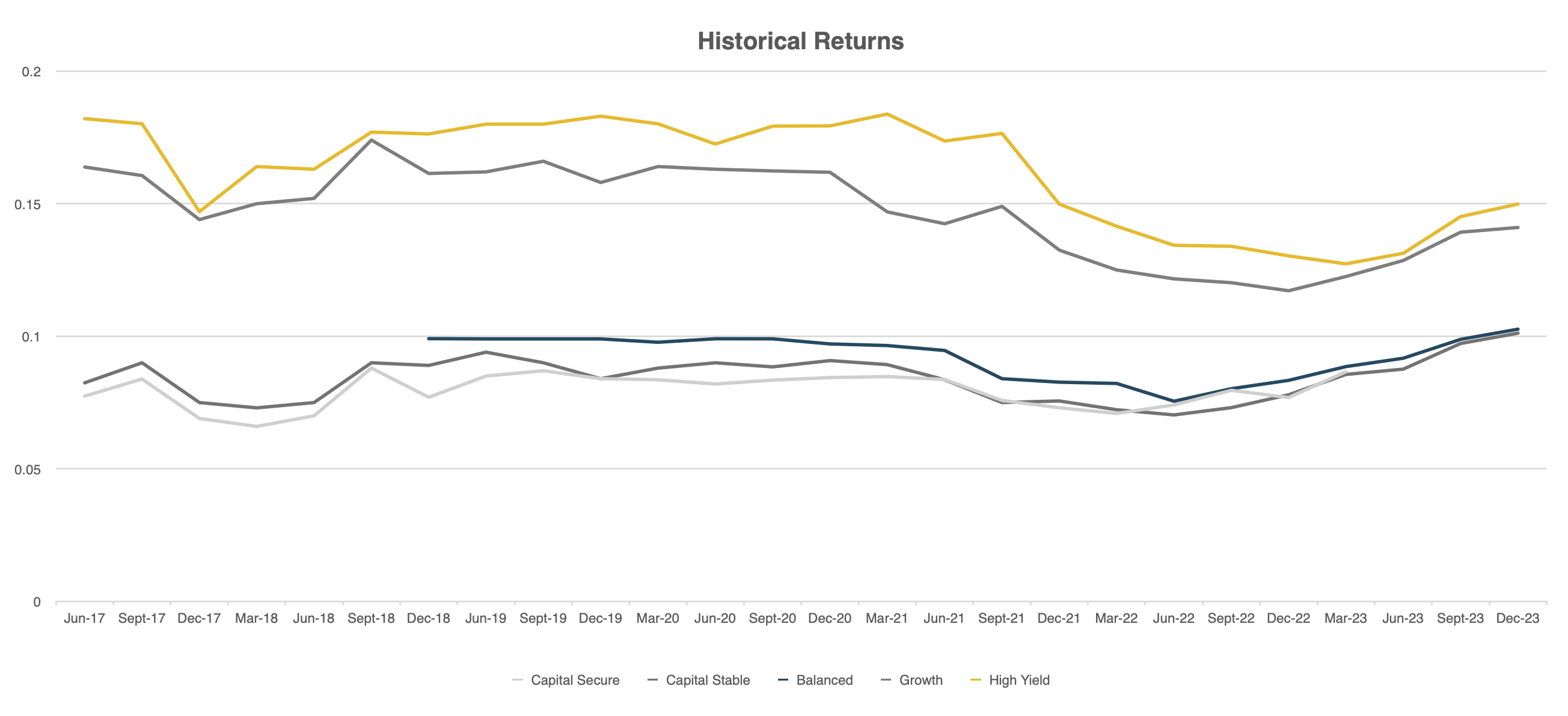

Payton Select Investments is one of the investment funds offered by Payton. In this fund, Payton provides you with information on each investment so that you can choose the ones you like and design your own portfolio. The select investments are categorized into five product types, each priced relative to its risk.

The risk profile is determined by a number of factors, including whether it’s a construction or non-construction investment, and the loan to value ratio (LVR) limit, which is important to protect against any volatility in the underlying property asset.

The Payton Pooled Investment Fund is another option offered by Payton. If you prefer Payton to choose and manage the investments for you, this fund is the way to go. In the pooled fund, investor funds are pooled in loans that are carefully selected by Payton’s team, so your investment is diversified across a large number of investments.

Each pooled product has a different risk profile, determined by the level of cash holdings, the type of loans it invests in, and its LVR limits.

Whether you’re invested in the Select Fund, the Pooled Fund, or both, you will receive monthly statements detailing your investment portfolio, your returns, and all account transactions for the month. And of course, your relationship management team is always available to answer any queries you may have.

Investing in private debt with Payton is easy. They do all the heavy lifting for you, and unlike the stock market, where returns can be volatile, investing in private debt offers consistent and regular returns with the added benefit of a mortgage over Australian real estate securing your investment.

Speak to Payton’s dedicated, experienced, and friendly team to get started today.

Investment Products

Payton Pooled Investment Fund

A pooled mortgage fund suitable for investors who prefer a managed investment experience, giving you access to a diversified pool of investments chosen and managed by us.

| Cash-Plus Account 3.5% – 5.5% |

|---|

| Capital Secure to Balanced Investments |

| Core Account 7% – 8.5% |

| Capital Secure to Balanced Investments |

| Opportunity Account 9.5% – 11.5% |

| Capital Secure to High Yield Investments |

* Historical returns are no guarantee of future performance. The reference to past performance above is intended to be for general illustrative purposes only.

* Early withdrawal fees may apply if minimum term requirements are not met.

# Returns in the Payton Pooled Investment Fund (‘Pooled Fund’) are variable and paid monthly. The rates of return from the Pooled Fund are not guaranteed and are determined by the future revenue of the Pooled Fund and may be lower than expected. Withdrawal rights are subject to liquidity and may be delayed or suspended.

^ An investment in the Payton Select Investment Fund and the Payton Pooled Investment Fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance.

Payton Select Investment Fund

A non-pooled mortgage fund suitable for investors who prefer to take a self-directed approach, allowing you to choose your investments and tailor your portfolio.

| Capital Secure 8.75% – 9.75% |

|---|

| First registered mortgage over an improved property up to an LVR of 60% |

| Capital Stable 9% – 10% |

| First registered mortgage over an improved property up to an LVR of 65% |

| Balanced 9.5% – 11% |

| First registered mortgage over vacant land or an active development site up to an LVR of 65% |

| Growth 13% – 15% |

| Second registered mortgage over an improved property up to an LVR of 75% |

| High Yield 15% – 18% |

| Second mortgage over an active development site up to an LVR of 80% of Net Realisable Value, or 90% of Total Development Cost |