The Australian Economy – Ready To Fire Post Lockdown

The Australian economy in late June was on track to outperform with very strong economic indicators across the board and COVID largely in check across the country. Victoria was on track to come out of Lockdown 5 and the rest of the country was open. This was until a limo driver in Bondi transported international flight crew unmasked and unvaccinated.

We have since seen much of the eastern seaboard plunged into various lockdowns with Australia’s two biggest states, VIC and NSW as well as the nation’s capital, ACT, in a perpetual lockdown until vaccination targets are met. The Delta strain of COVID 19 has proven to be too transmissible for lockdowns alone to defeat. The new trigger for partial opening of the country will be the agreed National Cabinet plan of 70% of people aged 16 years+ being fully vaccinated and then a full opening at 80%.

The effect on the economy of these lockdowns has been similar to what we have seen over the last 18 months and despite the long-lasting nature of these latest lockdowns we are still confident that when they lift, we will see consumers, business and the property market make up for locked down time.

What Have We Seen?

Unemployment

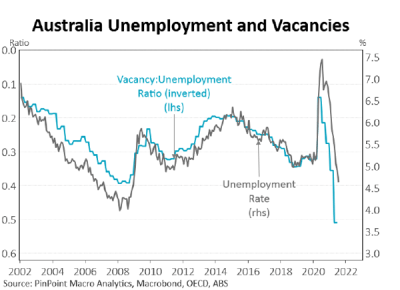

The labour market is very tight across most industries as closed boarders weigh on new workers entering the country and the workforce. The unemployment rate peaked in June 2020 at 7.4% and has fallen rapidly since with the latest print showing 4.6% in July 2021. We do expect the latest lockdowns to have an effect on this temporarily, but ‘post lockdown pick up’ should reverse any temporary rise in unemployment we see.

What we haven’t yet seen from the low unemployment rate is material growth in private sector wages which is a key determinant of spending and future inflation. Whilst there has been modest growth in wages, if we are going to see GDP growth via consumer spending, we need to see a much stronger level of wage growth in the months ahead.

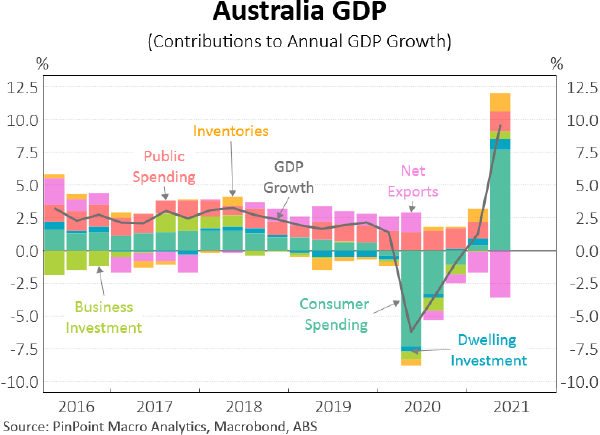

Economic Growth

The labour market is very tight across most industries as closed boarders weigh on new workers entering the country and the workforce. The unemployment rate peaked in June 2020 at 7.4% and has fallen rapidly since with the latest print showing 4.6% in July 2021. We do expect the latest lockdowns to have an effect on this temporarily, but ‘post lockdown pick up’ should reverse any temporary rise in unemployment we see.

What we haven’t yet seen from the low unemployment rate is material growth in private sector wages which is a key determinant of spending and future inflation. Whilst there has been modest growth in wages, if we are going to see GDP growth via consumer spending, we need to see a much stronger level of wage growth in the months ahead.

Where Are We Now?

Cash Rate

Interest rates remain at historical lows with the RBA cash rate stable at 0.1%. Whilst we have seen some movement in the 10-year Bond Yield, the recent lockdowns across NSW and VIC are likely to dampen expectations and subdue yields until we have some more clarity around opening of the country both domestically and internationally.

The CBA most recent forecast (28/8/2021) outlines a rate rise in 2023 to which they expect the first rate rise to be 15bp followed by steady increases of 25bp across 2023/24. Low rates coupled with expectations that future rises are some time off, should help to maintain the pre-lockdown confidence in property markets seen throughout Australia’s capital cities.

Savings

The household saving ratio has risen to multi-decade highs since the pandemic began which CBA estimates (16/9/2021) has built an unprecedented $230bn of household savings above what is normally saved. This accounts to circa 11.5% of GDP or $11,200 for every person over 16 years old. There is a very strong correlation between consumer sentiment and spending and this war chest of savings will give much confidence to business and Government that we are likely to see consumer spending drive forward the economy through 2022 when pandemic related fear subsides.

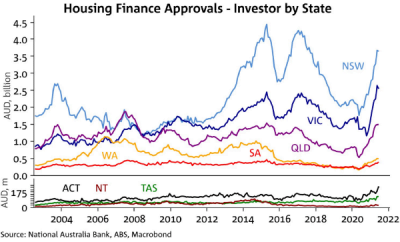

As confidence builds and people look to make up for locked down times, we expect to see a flurry of activity across all sectors of the economy with retail, hospitality and eventually domestic tourism being the big winners. We also expect to see much of this saving coupled with confidence translate into the property market via renovation, home upgrades and investment property purchases.

What Do We See?

Property Prices

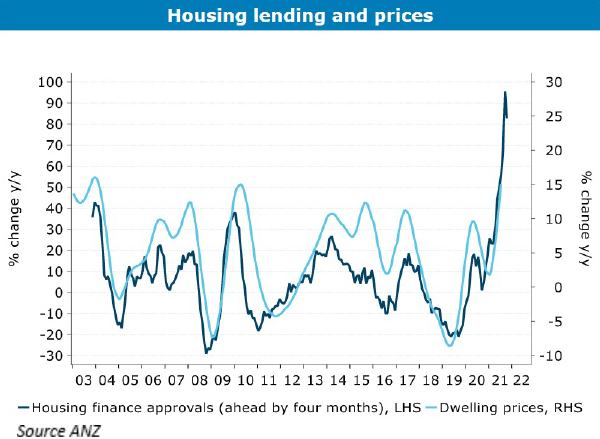

According to CoreLogic (Sept 2021) we have seen increases in property prices across the country in the last year with the 5 major capital city aggregate price movement 17.24% higher year on year. There is a clear correlation between housing lending and prices so we expect the surge in lending approvals likely to translate into continued price pressure for buyers as the approvals turn into purchases.

The recent announcements by the Federal Government to impose new controls on home lending is nothing new, rather it’s a slight retightening after banks relaxed lending rules in the wake of the changes made after the Hayne Royal Commission.

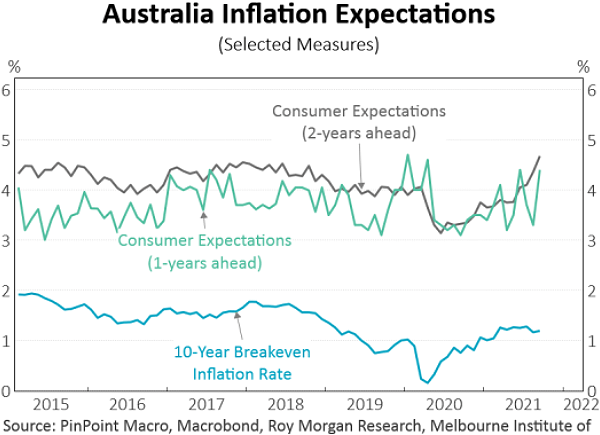

Inflation

Finally, to inflation, the key concern of current RBA monetary policy and the indicator we are watching closely for when we may see interest rate movement. The RBA is keen to see inflation track back towards the 2-3% target band before they consider interest rate policy. This will largely be determined by the level of consumer spending we see post lockdown, hopefully sustained by the huge savings reserves, future wage growth off the back of a tight labour market and low unemployment.

The RBA forecast for inflation is 1.75% at the end of 2022 rising to 2% into 2023. Whilst we acknowledge this forecast, Payton has already seen sharp increases in the cost of building materials impacting price and reports of escalation across agriculture, technology and energy are likely to test this thesis.

Craig Schloeffel | Head of Investment | craig.schloeffel@payton.com.au

Disclaimer: The information contained in this document is of a general nature and does not take into consideration the investment objectives, financial circumstances or needs of any particular recipient – it contains general information only. The views expressed in this document are solely those of the author and are subject to change without notice. A

ny financial projection and other statements of anticipated future performance that are included in this document are for illustrative purposes only and are based on assumptions that are subject to risks and uncertainties and may prove to be incomplete or inaccurate. Actual results achieved may vary from the projections and the variations may be material.

Before deciding to make an investment with Payton, you should carefully read all of the information in the relevant Fund Information Memorandum, and consult with your business adviser, financial planner, accountant or tax adviser. Reliance upon information in this document is at the sole discretion of the reader.

Payton Capital Ltd is an authorised representative of Payton Funds Management Pty Ltd ABN 32 107 613 258 AFSL 284280.

About the author / Craig Schloeffel

~~ Related Posts ~~

Payton Capital Quarterly Economic Update March 2024

By Craig Schloeffel|2024-03-28T17:00:25+11:00March 28, 2024|

Payton Capital Quarterly Economic Update December 2023

By Craig Schloeffel|2023-12-15T12:16:58+11:00December 15, 2023|

Media Release: Payton Capital’s Queensland Expansion

By Jodie Elg|2024-01-25T11:28:11+11:00October 20, 2023|

Payton Capital Quarterly Economic Update September 2023

By Craig Schloeffel|2023-09-28T16:51:27+10:00September 28, 2023|

Payton Capital announce Chief Risk Officer Appointment

By David Payton|2023-10-20T14:46:25+11:00September 25, 2023|

Australia’s Housing Crisis is on the Verge of Imploding

By David Payton|2023-08-17T15:47:33+10:00July 4, 2023|

Payton Capital Economic Update June 2023

By Craig Schloeffel|2023-07-03T14:19:54+10:00June 30, 2023|

Foresight Analytics Upgrades Payton Capital’s Operational Due Diligence

By Jodie Elg|2023-09-19T17:41:20+10:00June 12, 2023|

Payton Capital Economic Update March 2023

By Craig Schloeffel|2023-07-04T14:40:08+10:00March 23, 2023|

Economic Update December 2022

By Craig Schloeffel|2023-08-18T14:01:07+10:00December 12, 2022|

Economic Update September 2022

By Jodie Elg|2023-09-18T18:39:37+10:00September 6, 2022|

Foresight Analytics rates Payton Capital Funds as STRONG

By Jodie Elg|2023-08-17T16:46:59+10:00June 17, 2022|