CEO update: Small steps to recovery

I hope that you and your families remain well and are surviving this second round of lock-downs. Hopefully the road map soon to be announced is not too onerous and the new post-COVID normal now within reach. As we all continue to manage our mental health, one day at a time, again we at Payton continue to take stock and remain thankful for where we are and how far we have come.

Despite the frustration and negative media bombardment, we remain positive, optimistic and determined. We try to respond to the negative sentiment in the “opposite spirit” to overcome fear with facts and to be part of the solution.

Economic green shoots continue

The latest economic data is encouraging:

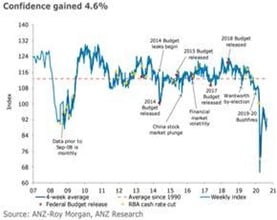

- Strong recovery in all states, bar Victoria

- Stage 4 battered confidence, but the past few weeks we are back on the rise

- Consumption will drive recovery, so we all have a part to play

Low default rates and no sign of “fiscal cliff”

Low default rates and no sign of “fiscal cliff”- Banks are well capitalised – secondary markets liquid

- Banks continue to lend and interest rates are at all time lows

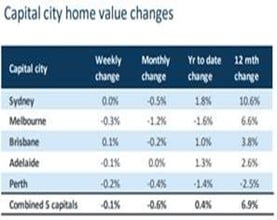

Only -1.6% year to date, 6.6% up YOY!

Only -1.6% year to date, 6.6% up YOY!- Further stimulus supporting growth and new building starts

- Post lock-down will see full picture, however no longer expected to be dramatic decline

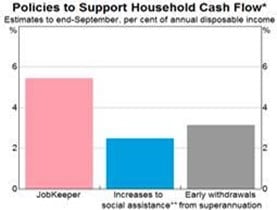

- Government stimulus has worked

- Consumers are cashed up!

- Expecting more targeted stimulus enabled by our Government’s strong credit rating and borrowing power

Projects approaching completion

Despite COVID-19, our projects continue to reach completion and despite some delays, continue to deliver excellent returns for both our borrowers and investors.

Grey Street, Traralgon 50 room Mantra Hotel, cinema, bowling alley and retail

Grey Street, Traralgon – interior

Grey Street, Traralgon 50 room Mantra Hotel, cinema, bowling alley and retail

Scheduled completion and opening October, 2020

Loan maturity December, 2020

Milan Street, Mentone -4 Townhouses

Milan Street, Mentone -4 Townhouses

Milan Street, Mentone -4 Townhouses

Milan Street, Mentone – 4 Townhouses

Completion mid-October, 2020

Loan maturity 13 December 2020

Springvale Road, Glen Waverley – 5 Townhouses

Springvale Road, Glen Waverley – 5 Townhouses

Springvale Road, Glen Waverley – 5 Townhouses

Springvale Road, Glen Waverley – 5 Townhouses

Completion September, 2020

Loan maturity, overdue

Investment opportunities

In the past three months we have deliberately increased the liquidity in our 48-Hour Cash-Plus option. As a result, the benchmark monthly return has been reduced to 3% p.a. (down from 4% p.a.) which we believe continues to represent excellent value for our investors relative to the market on a like-for-like basis. For those seeking a higher return, and happy to commit for a longer term, many investors are choosing the 6 or 12 month options.

Pooled Fund Options

| 48 Hour Cash plus | 6 Month Term | 12 Month Term |

|---|---|---|

| 3% p.a. | 6% p.a. | 7% p.a. |

Select Mortgage opportunities have also grown in the past four weeks and we anticipate a return to the “new normal” post COVID in the December quarter. We have observed an increase in competition in the past month with the Private Debt market place appearing to be awash with funds.

As such, it may be a little more difficult to extract a significant premium over and above pooled option returns for individual transactions moving forward, however the ability to choose specific loans in which to invest, tailor return for risk and build your own portfolio is still a very attractive option for those who are ‘active investors’.

Once again, thank you for your continued support. Should you have any specific queries or concerns, please reach out to your Relationship Manager.

I’m also happy to receive any feedback or queries directly as some of you have done from time to time.

Regards,

David Payton

CEO

About the author / David Payton

~~ Related Posts ~~

Payton Capital Quarterly Economic Update March 2024

By Craig Schloeffel|2024-03-28T17:00:25+11:00March 28, 2024|

Payton Capital Quarterly Economic Update December 2023

By Craig Schloeffel|2023-12-15T12:16:58+11:00December 15, 2023|

Media Release: Payton Capital’s Queensland Expansion

By Jodie Elg|2024-01-25T11:28:11+11:00October 20, 2023|

Payton Capital Quarterly Economic Update September 2023

By Craig Schloeffel|2023-09-28T16:51:27+10:00September 28, 2023|

Payton Capital announce Chief Risk Officer Appointment

By David Payton|2023-10-20T14:46:25+11:00September 25, 2023|

Australia’s Housing Crisis is on the Verge of Imploding

By David Payton|2023-08-17T15:47:33+10:00July 4, 2023|

Payton Capital Economic Update June 2023

By Craig Schloeffel|2023-07-03T14:19:54+10:00June 30, 2023|

Foresight Analytics Upgrades Payton Capital’s Operational Due Diligence

By Jodie Elg|2023-09-19T17:41:20+10:00June 12, 2023|

Payton Capital Economic Update March 2023

By Craig Schloeffel|2023-07-04T14:40:08+10:00March 23, 2023|

Economic Update December 2022

By Craig Schloeffel|2023-08-18T14:01:07+10:00December 12, 2022|

Economic Update September 2022

By Jodie Elg|2023-09-18T18:39:37+10:00September 6, 2022|

Foresight Analytics rates Payton Capital Funds as STRONG

By Jodie Elg|2023-08-17T16:46:59+10:00June 17, 2022|