Payton Capital Quarterly Economic Update June 2024

EXECUTIVE SUMMARY

Monetary policy is often said to operate with a lag and this is evident in Australia. Despite over seven months passing since the last interest rate hike, the economy continues to cool. In addition, inflation is expected to decline further in the second half of 2024, as economic growth slows and unemployment rises.

Markets are now anticipating a rate cut in 2025 rather than at the end of 2024. However, for the property market, these cuts hold little significance. Property prices are up and are expected to continue climbing as monetary policy eases.

We believe that this deviation to what we would expect from monetary policy is due to structural undersupply driving the demand for the property market. Interest rates have long been a key factor in house prices, especially given Australia’s high debt-to-income ratio. Despite enduring the fastest and largest continuous rate-hiking cycle, Australian property has emerged stronger.

The current property market dynamics go beyond credit markets; it is about providing housing. High migration levels, coupled with low approval and start rates, have created a housing demand that remains unmet and will continue to be until Australia starts building far more homes at pace. While the RBA’s future actions may further stimulate the property market, the true drivers of the market now are builders and developers.

WHAT HAVE WE SEEN?

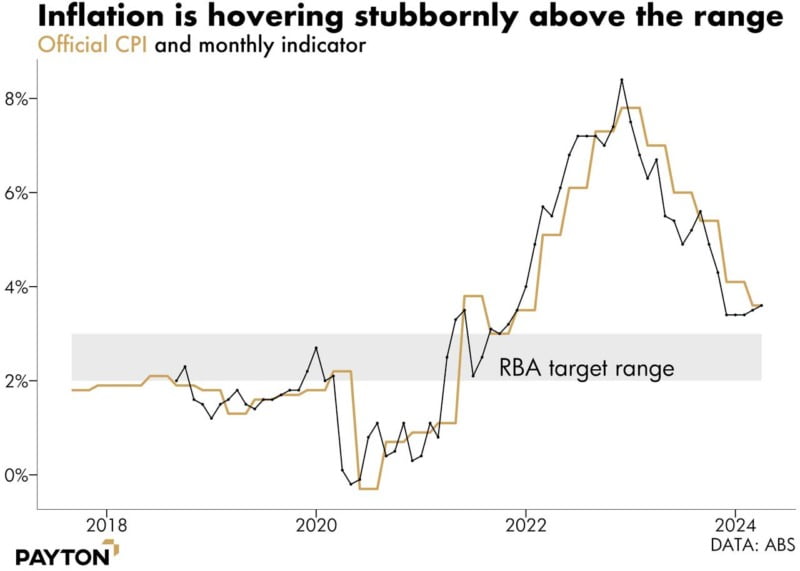

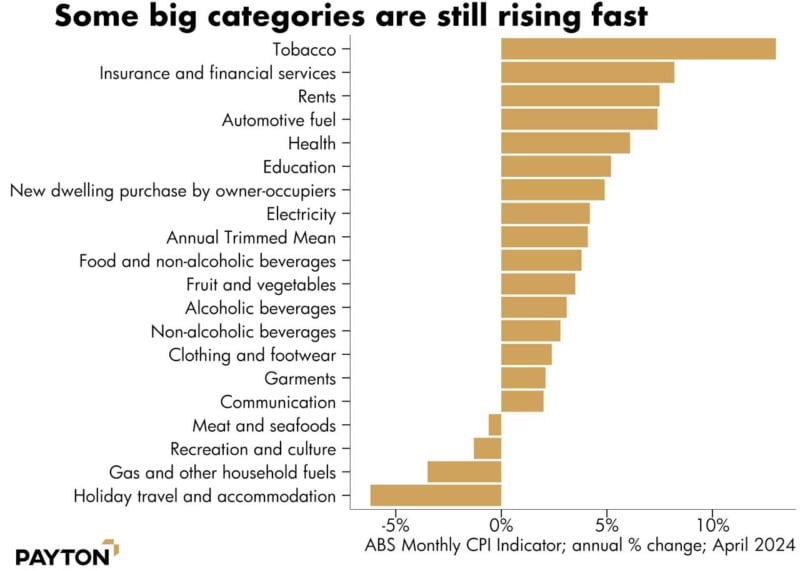

Inflation in Australia is mimicking inflation in other major countries by dancing just above the target range. The US, Australia and to a lesser extent the UK, have all seen inflation plunge only for it to then hit the brakes just outside the range central banks are comfortable with. Australia’s inflation is 3.6 per cent as measured by the monthly indicator and by the official quarterly measure.

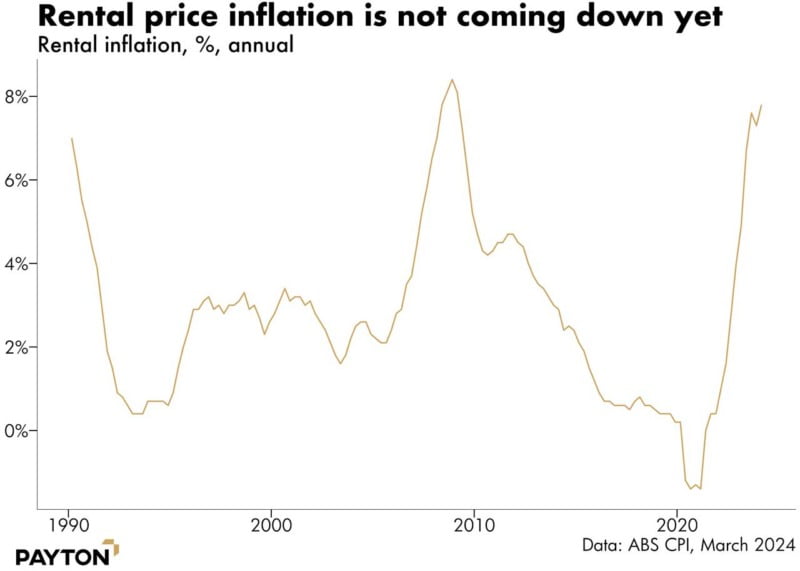

Price growth is now found in a range of categories, in particular domestic service industries like insurance and health. Rents are also rising strongly, and are unlikely to relent in the medium term as the building industry responds slowly to the boom in population.

Is inflation stuck? Perhaps. But maybe not, as the Federal Budget has given it a deliberate push. The Budget will have a direct impact on the consumer price inflation index. The 2024-25 Budget included several measures which are designed to cap consumer prices, including household energy subsidies and additional rent assistance. These measures will bring down inflation “mechanically” in the short term and is why the Federal Treasurer has been arguing inflation could be back in the target band before the end of the year.

Targeting the CPI print itself rather than helping the economy produce output without rising prices might be cynical, but might also prevent inflation running away. The official CPI print (the figure produced by the Bureau of Statistics each quarter) is an input to wage negotiation and all sorts of indexation rules. Mechanically lowering it by half a percent could be useful in getting the economy back to an even keel, even if inflation does bounce back a little when the counter-inflation measures end.

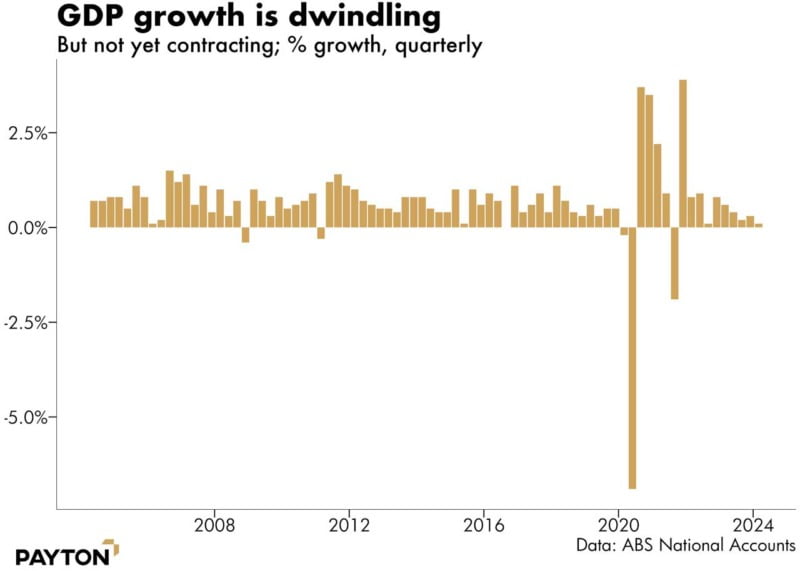

Despite some lingering inflation, the RBA is not expected to raise rates again. With economic growth teetering on the brink of contraction, it seems likely that enough has been done to cool the economy. We remain on the “narrow path” that balances inflation-fighting and keeping the economy out of recession. The path is indeed narrow, however, growth in the March quarter was a very modest 0.1 per cent, leaving annual growth at 1.1 per cent.

In per capita terms, of course the economy is going backwards. Per person, GDP fell 1.3 per cent over the year to March 2024. But a true recession is a much more destructive force than a per capita recession, causing widespread unemployment and business failure. We are not seeing that, as aggregate spending is still rising. Household spending grew in the March quarter, primarily due to a rise in essential spending on electricity, medical expenses, etc.

Retail sales growth was just 1.3 per cent in the year to April 2024 which is negative in per capita terms.

Thankfully, not everything is doom and gloom. The official national accounts release made what appears to be a reference to Australian’s willingness to spend on entertainment, otherwise known as the Taylor Swift effect. “Record attendance at large scale sporting and music events saw increased spend on hotels, cafes & restaurants, and clothing & footwear,” the Bureau of Statistics noted. But other than buying tickets to see a travelling songstress, consumers are despondent and consumer confidence is sagging, as the next chart shows.

WHERE ARE WE NOW?

Instead of a rate hike, the RBA’s next move is expected to be a cut. At time of writing, interest rate futures markets price a rate cut by mid next year as a certainty. If that is delivered it will help relieve household budgets and put more fire under the housing market.

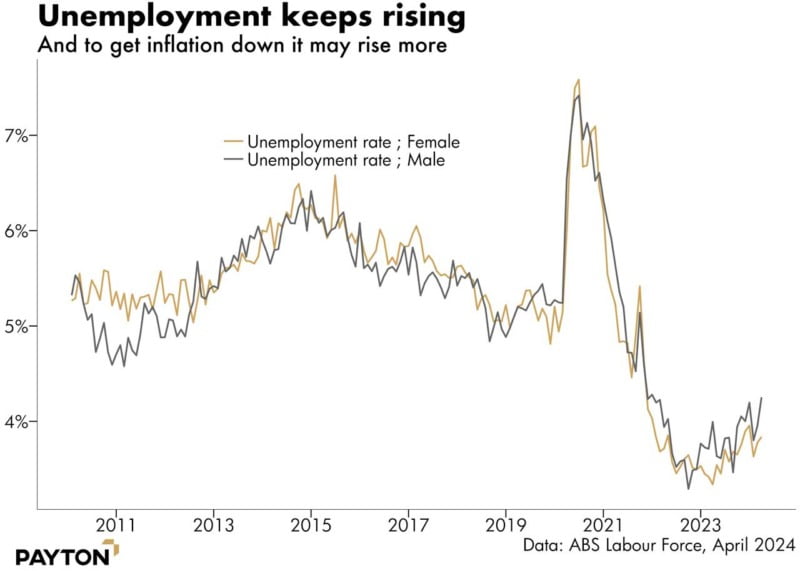

Key among the factors reducing pressure on the RBA is the unemployment rate. It is doing exactly what it is supposed to, rising, albeit slowly and haphazardly. This is reducing the risk that the labour market remains tight enough for a wages breakout. As the next chart shows, Australia’s unemployment rate is now just on 4 per cent, higher for males than females.

This chart shows a very low unemployment rate by historical standards, and one that is delivering stable incomes for most Australian families. Still, the rising rate of unemployment has taken the sting out of wages. Leading indicators of wages suggest that wages growth is falling: the Seek Advertised Salary index shows growth ebbing from nearly 5 per cent to 4.3 per cent in the most recent data.

The rate of underemployment is also relevant for wages and that has risen too, from 6 per cent to 6.6 per cent.

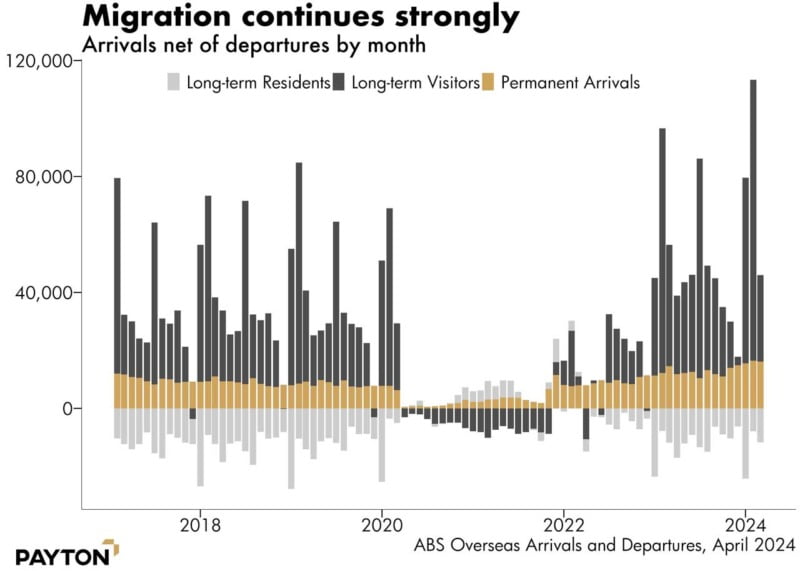

Among the reasons for a softening labour market is continued strong migration bringing in numerous willing workers. As the next chart shows, migration continues to be strong, with more arrivals than departures.

All these new arrivals need a place to live, and that is the explanation for the state of the housing market. Housing should be falling in a rate cycle like this, but we have gone through the fastest tightening cycle in decades and housing has barely blinked. The reason is that housing demand is a combination of the market for a place to live and the market for loans. Even if one side is getting tighter, the other side can underpin demand.

Currently, the market for loans has tightened, but the demand for housing is supporting the property market. During the pandemic, we saw the reverse: a shrinking population but with low interest rates that ultimately propped up the market. Even more explosive growth could be seen if rates fall and the population continues to grow or has residual unmet housing needs.

High unmet demand for housing is likely to persist for a long time as Australia deals with the structural undersupply it faces. This demand is first evident in the rental market data, as newcomers to a country typically start by renting. Therefore, rents can be seen as a leading indicator for overall property prices.

And rents are high and rising, as the next chart shows.

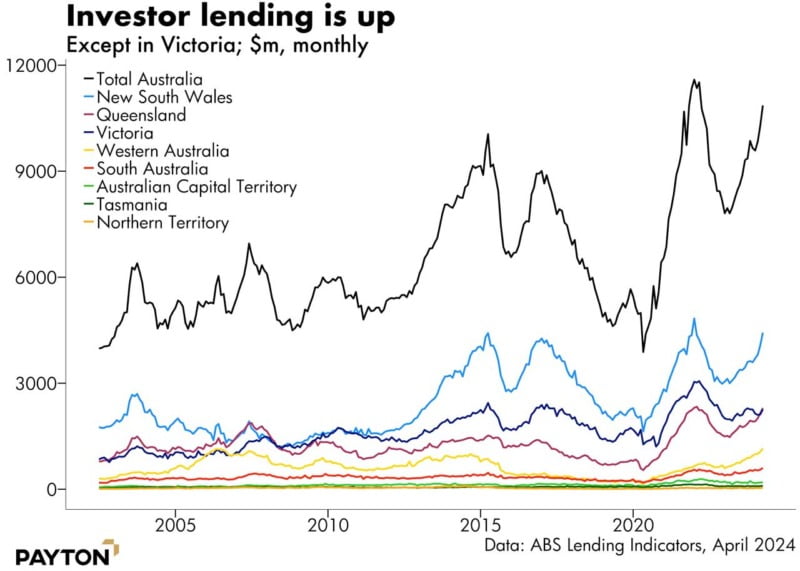

Usually rising rents would mean higher yields, landlords rushing into the market and higher supply. That is starting to happen, slowly. However, Victoria is an exception. The introduction of taxation for empty dwellings and the lowering of the land tax threshold has created an outflow of investors to other Australian states.

WHAT DO WE SEE?

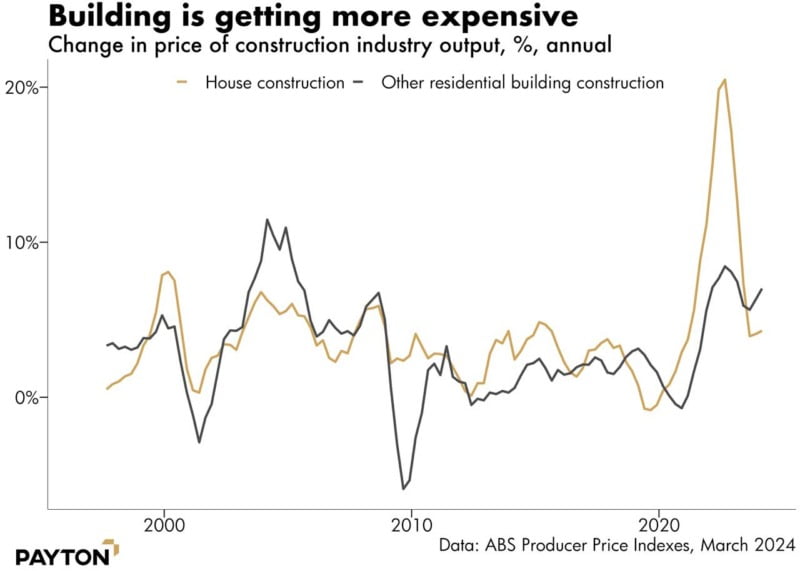

A lot of homes will need to be built, but the housing market is not yet responding to this demand. A major reason is the price of building. The recent spate of construction sector insolvencies tells the tale, with high input prices making life hard for builders, and higher home prices required to get a surge of new starts.

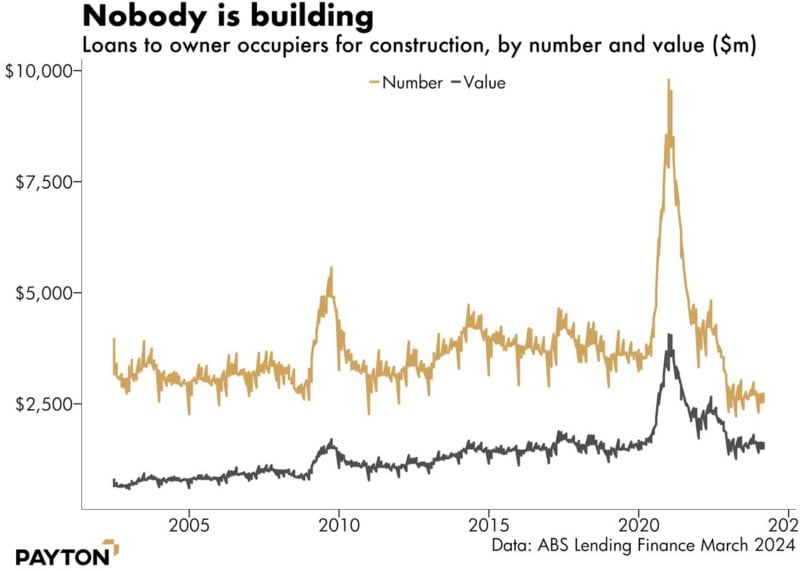

At the moment, the number of new homes being built is low in historic terms, and the number of loans to owner occupiers for construction is at insipid levels.

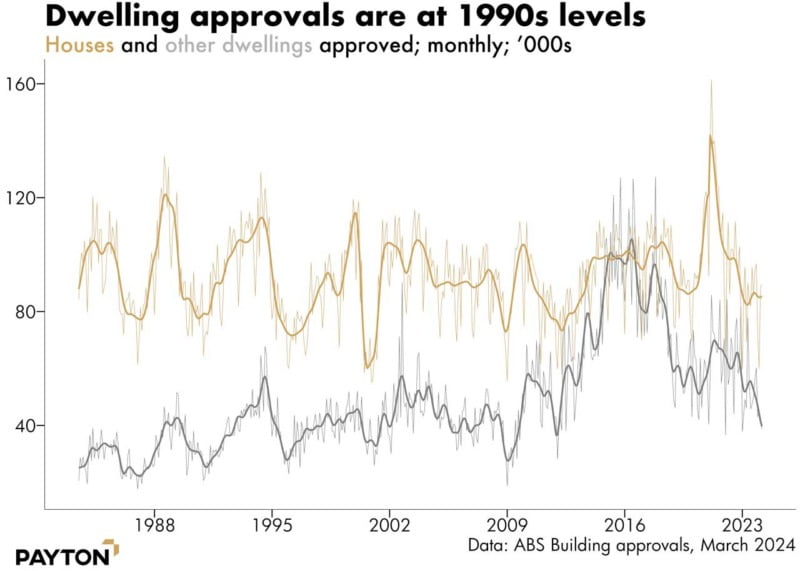

You might have expected Australia to be rushing new supply into market. Instead, the number of dwellings being approved is languishing around the same level we’ve seen for decades.

Dwelling approvals are just the first step in getting a home built. Approvals turn into liveable homes over a period of many months or years. The current downturn in building approvals tells us that the housing shortage will not be solved in the next couple of years.

The reason? Building a house is more expensive now. Developer profit margins are squeezed by the high cost of inputs and shortage of trades. Only the safest projects are being undertaken. But that is not bringing enough supply to market. As a result, higher house prices are likely to be required in the market for new homes to balance.

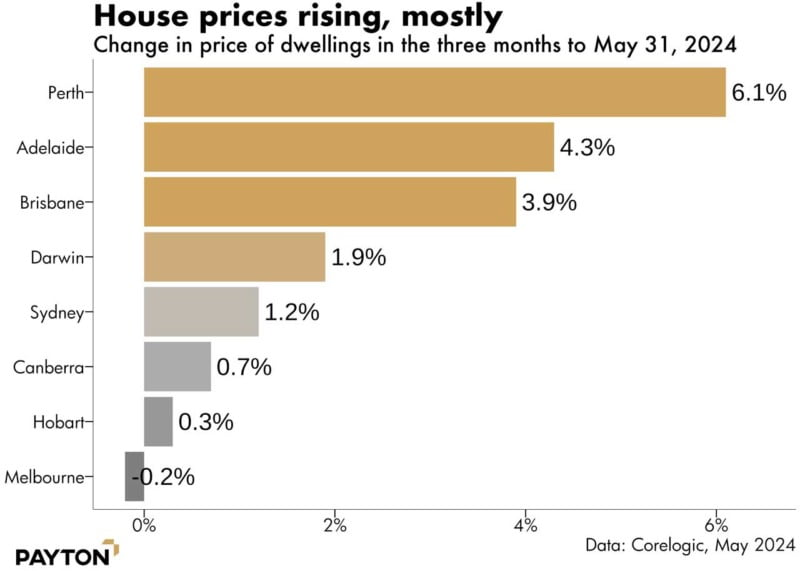

So, are residential property prices rising? The answer is yes. As the next chart shows, prices are rising in most markets, with Perth the stand-out performer and Melbourne the exception. Perth’s property market stalled for a while but is now catching up to the rest of the country. Meanwhile, Brisbane’s strong result means its market is now Australia’s second-most expensive.

The return of investors, mentioned above, is part of what is driving demand, but high population growth is a bigger part of the picture. Even with a reduced rate of household formation – young people staying home with their parents to save money, young couples living in share housing, etc. – the demand for homes is being driven by the number of people in the country. For now, those people are largely renting but as their time in Australia stretches out, they will consider buying.

We see the lack of price growth across the Melbourne market continuing to drive affordability relative to other markets. This in turn will drive further demand and eventually materialise in price growth given the fundamentals of Melbourne as a large-scale city with large employment prospects, infrastructure and wage index.

Rents could be the last part of the inflation index to fall. The price of rents is slow to move and the effect of even a short burst of higher-than-normal migration will emerge over a long time. Rent contracts are not updated daily like petrol prices and even then, rent hikes can in some cases be limited by law. That means high rental inflation will be a protracted affair and for the CPI to fall back into the 2 to 3 per cent range, other categories will need to be rising by less than 2 to 3 per cent.

Achieving that will take time but is not impossible. The Australian economy is likely to even out in the next quarter with low growth and inflation edging ever closer to the RBA target range. Interest rate cuts will become a nearer and more concrete prospect. However, the property market is likely to continue in a similar vein, delivering solid price rises in most major markets, as people bid for a roof over their heads and the rate of building remains too low to eradicate the undersupply.

We expect that the undersupply will continue to deliver fantastic opportunities for investors to support new residential projects across Australia underpinned by a structural need from both government and the public to increase supply.

Disclaimer: The information contained in this document is of a general nature and does not take into consideration the investment objectives, financial circumstances or needs of any particular recipient – it contains general information only. The views expressed in this document are solely those of the author and are subject to change without notice. Any financial projection and other statements of anticipated future performance that are included in this document are for illustrative purposes only and are based on assumptions that are subject to risks and uncertainties and may prove to be incomplete or inaccurate. Actual results achieved may vary from the projections and the variations may be material. Before deciding to make an investment with Payton, you should carefully read all of the information in the relevant Fund Information Memorandum, and consult with your business adviser, financial planner, accountant or tax adviser. Reliance upon information in this document is at the sole discretion of the reader. Payton Capital Ltd is an authorised representative of Payton Funds Management Pty Ltd ABN 32 107 613 258 AFSL 284280

About the author

~~ News & Insights ~~

Payton Capital Quarterly Economic Update September 2024

By Craig Schloeffel|2024-10-01T16:44:22+10:00September 24, 2024|

Payton Capital Quarterly Economic Update June 2024

By Craig Schloeffel|2024-07-02T17:01:11+10:00June 21, 2024|

Payton Capital Announces Acquisition by ASX Listed HMC Capital

By Jodie Elg|2024-12-18T17:45:48+11:00May 24, 2024|

Payton Capital Quarterly Economic Update March 2024

By Craig Schloeffel|2024-07-02T17:07:49+10:00March 28, 2024|

Payton Capital Quarterly Economic Update December 2023

By Craig Schloeffel|2024-07-02T17:10:56+10:00December 15, 2023|

Media Release: Payton Capital’s Queensland Expansion

By Jodie Elg|2024-12-18T17:47:03+11:00October 20, 2023|

Payton Capital Quarterly Economic Update September 2023

By Craig Schloeffel|2024-07-02T17:14:08+10:00September 28, 2023|

Australia’s Housing Crisis is on the Verge of Imploding

By David Payton|2024-06-21T13:25:40+10:00July 4, 2023|

Payton Capital Economic Update June 2023

By Craig Schloeffel|2024-07-02T17:16:49+10:00June 30, 2023|

Foresight Analytics Upgrades Payton Capital’s Operational Due Diligence

By Jodie Elg|2024-12-18T17:47:04+11:00June 12, 2023|

Payton Capital Economic Update March 2023

By Craig Schloeffel|2024-07-02T17:20:11+10:00March 23, 2023|

Payton Capital Quarterly Economic Update December 2022

By Craig Schloeffel|2024-07-02T17:23:33+10:00December 12, 2022|