Payton Capital Quarterly Economic Update March 2024

Executive summary

Australia’s economic trajectory is clear now. The post Covid boom has firmly halted and the heat has come out of the economy. The next question in our mind is not if, but when, and how many interest rate cuts are coming?

You don’t need to look far to find the effects felt by the record-breaking tightening of monetary and fiscal policy. Unemployment is up, retail spending is down and consumer confidence remains at incredible lows. This is an economy that needs a boost to steady its trajectory and the RBA will deliver it. They don’t want a recession, or to even sail close to one, especially given recently experienced events.

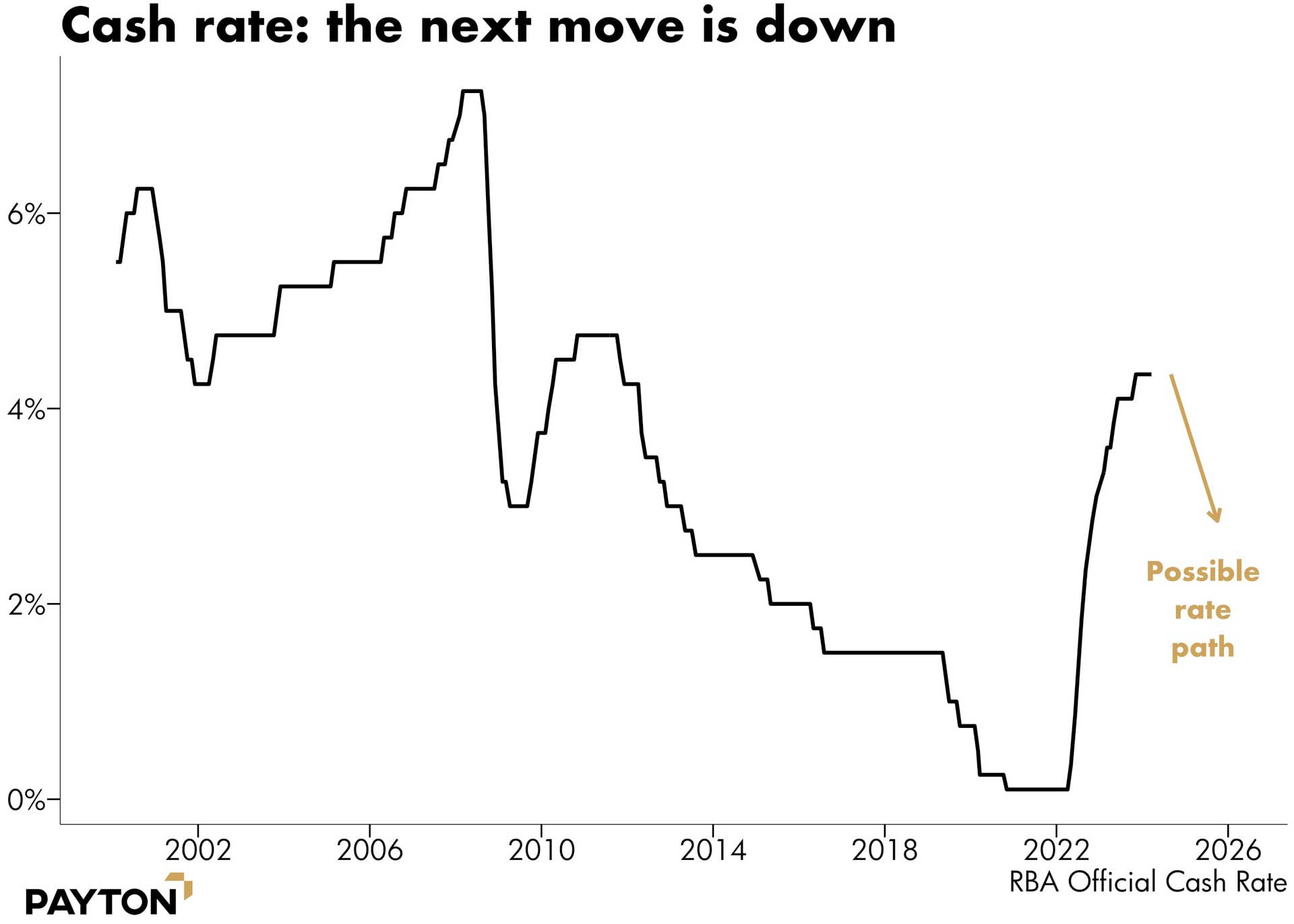

Official interest rates can be expected to fall from their current levels of 4.35 per cent via a series of cuts. Those cuts will, we expect, begin later this year. While there is significant noise in the market about when these cuts will occur, our best guess is that September will signal the start of the cut cycle.

These cuts are necessary to elevate the consumer economy but they will play into a housing market that has weathered the storm and which will welcome the flow of capital a reduced lending rate brings. In fact, this may end up tempering the speed with which the RBA executes its rate cuts because the housing market has not proved nearly as feeble as some predicted. An unprecedented rate of population growth, constrained supply and falling approvals has created a very strong footing for future housing demand.

The coming rate cuts will improve borrowing power for investors and owner-occupiers alike and we believe will deliver an even stronger residential property market. That shift should arrive alongside a more positive outlook for consumers and contribute to greatly improved sentiment throughout the economy.

What have we seen?

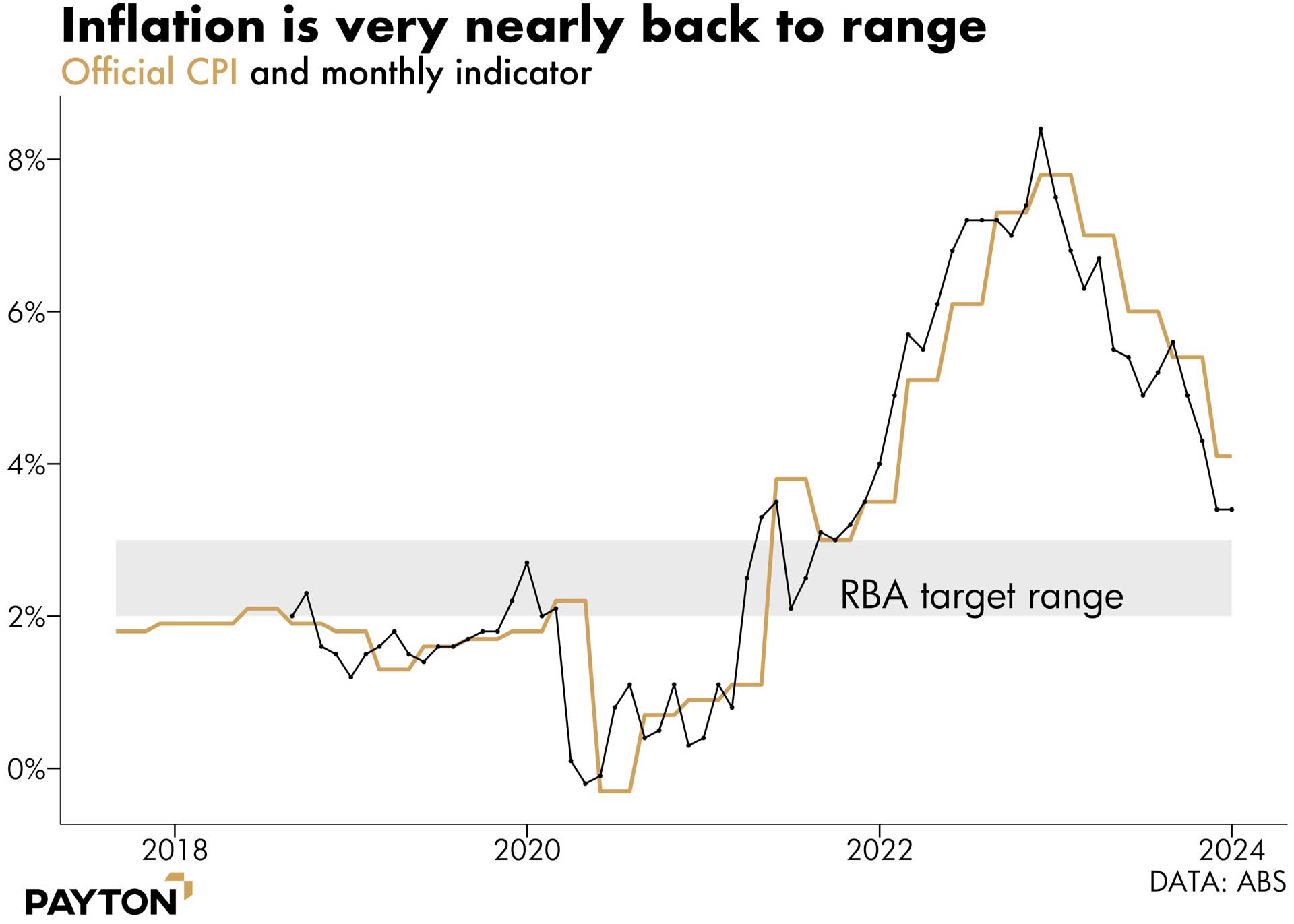

Inflation is falling. The rate of consumer price index or inflation (CPI) has tumbled back towards the target band as quickly as it could have been hoped for. It is not back in the range yet, as the following chart shows, but the fall has been as rapid as the rise, marking an inverted V on the chart.

The question at this point is whether the last little gap between our current inflation rate and the target band of 2 to 3 per cent proves harder to bridge or whether inflation continues to fall.

The RBA is forecasting inflation to fall at a reduced pace from here. The central bank is expecting CPI to fall under 3 per cent during 2025. But they expect it won’t reach the midpoint of the target range until 2026. If inflation falls faster, rate cuts will need to be more numerous and arrive sooner.

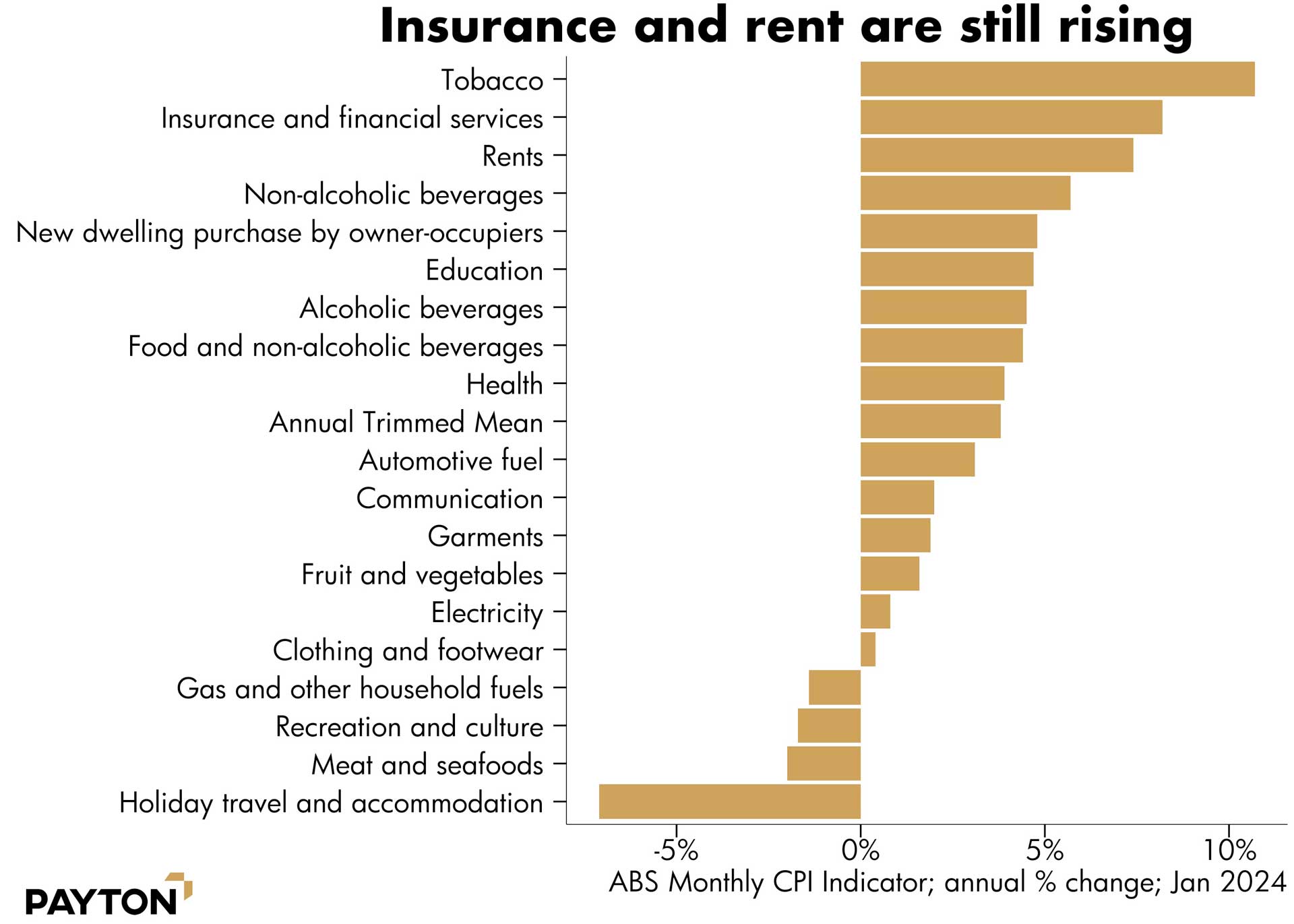

While many categories of inflation have already fallen, can we eradicate the last few sources? Remaining inflation is mostly concentrated in a few non-discretionary items, like insurance and rent. (Tobacco inflation is a policy choice driven by taxation).

With further interest rate rises now very unlikely given the trajectory of inflation, Australians are keen to understand when rate cuts will be passed down by the RBA. We believe that relief will be felt in September and, according to the Commonwealth Bank, it will be the beginning of a series of cuts.

“We have 75bp of rate cuts in our profile in late 2024 and a further 75bp of easing in H1 25, which would take the cash rate to 2.85%,” CBA’s Head of Australian Economics Gareth Aird wrote in a note to clients in March.

Under the new RBA regime there are fewer meetings each year, just four in the second half of 2024. This raises the pressure on the RBA to get the decision right at each meeting, but reduces uncertainty about when rate changes might happen. The most likely options at this stage appear to be early August, late September and early November. A mid-December rate cut is possible if the economy is spoiling and Christmas shoppers need a jolt of enthusiasm.

Futures markets are confident that a rate cut will be delivered by the end of September. Those markets aggregate bets on future official interest rates and therefore provide a guide from people who trade with real money. They are pricing in 25 basis points of cuts by October and a strong chance of another cut by the end of the year. The Payton Capital view is two to three cuts in 2024.

The fine details depend on data, which can be volatile in the short term.

Unemployment, for example, has soared then crashed in seasonally adjusted terms, moving up to 4.1 per cent in January before tumbling back down to 3.7 per cent in February. More data will be necessary to help the RBA understand where the signal is compared to the noise. The stronger February result may turn out to be a blip, as leading indicators point to continued weakening in the labour market. The job advertisement series run by SEEK showed job ads falling 2.5 per cent in February, while the ANZ-Indeed job advertisement series fell by 2.8 per cent. Both of those foretell unemployment rising back above 4 per cent before long.

SEEK’s advertised salary index also showed weakness in the most recent month, rising by just 0.2 per cent in January, the lowest monthly result in several years. The official wage price index comes out much less frequently but also showed a slight dip in the most recent data for the December quarter in 2023. It all adds up to a weakening labour market that will make it easier for the RBA to cut rates.

Where are we now?

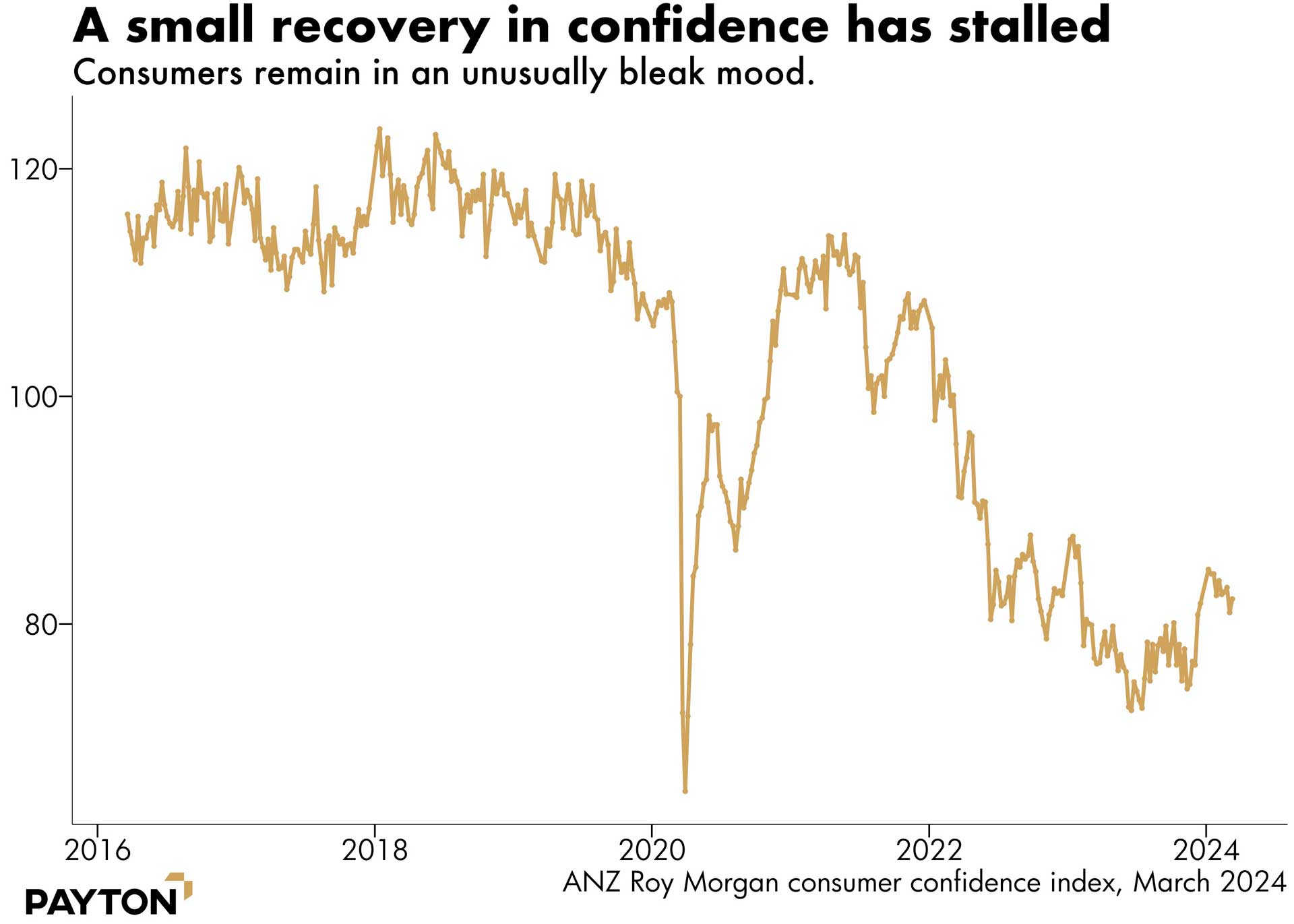

Consumer confidence would no doubt benefit from a rate cut sooner rather than later. Confidence has barely risen from its recent unprecedented, sustained lows as the next chart shows.

Consumer confidence is traditionally highly correlated with interest rates and CPI. But not necessarily inflation as it is officially measured. Consumers have long memories – while official inflation is measured only over 12 months, consumers may perceive prices are “too high” even after the ABS reports 12-month price changes are back in their target range. For that reason, defeating inflation on paper may not lead to consumers feeling a sense of victory over high prices. Quite some time may be required for the price level to seem normal again and for consumers to come out of their shell.

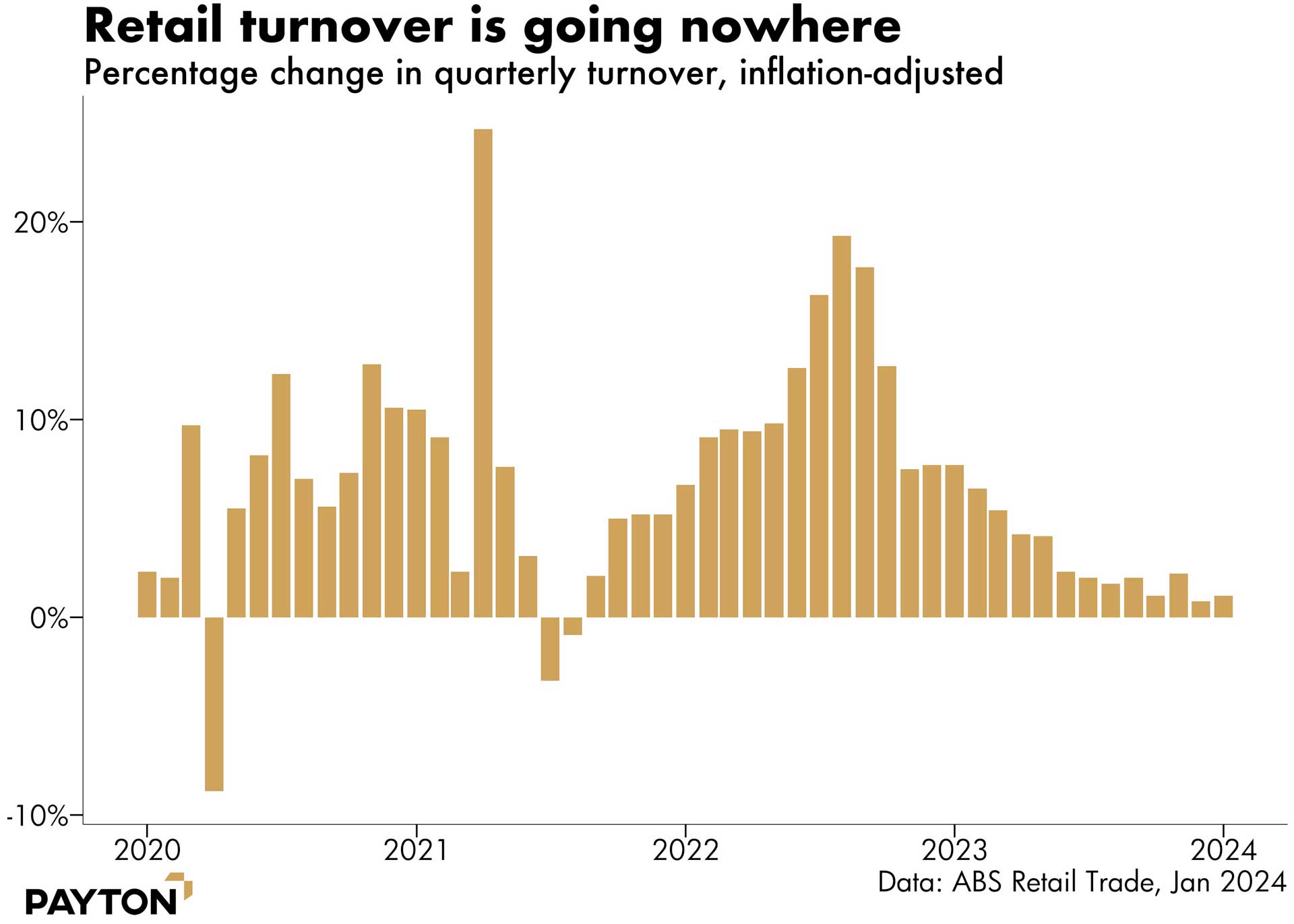

If there is such a lag it will be disappointing for retailers. Consumer spending has been weak as the next chart shows. Growth in retail spending was just 1.1 per cent over the last year – a poor result when the population grew by 2.5 per cent and indicative of extreme consumer caution.

Weak spending is flowing through to consumer-facing companies. For example, when Harvey Norman reported its half-year results in February it confessed to the market that total system sales revenue was lower than the preceding three years. Australian revenue was down sharply from the year before and profit before tax fell too. This company is not an exception to the rule. There can be no question that rate hikes have worked on consumers just as intended.

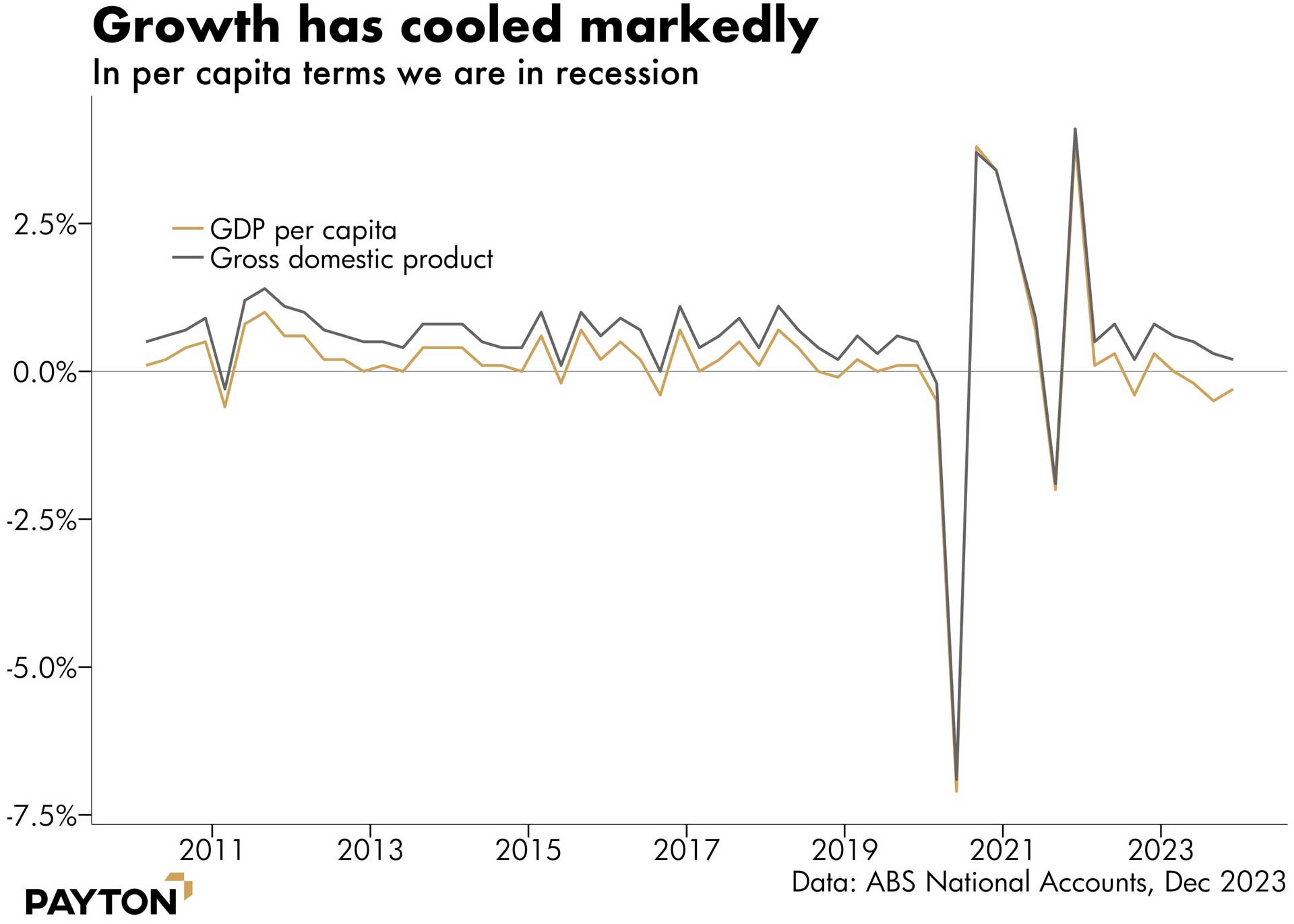

Economic growth has fallen enough to give the RBA confidence the economy is not running hot. In the December quarter, i.e. October-December 2023, the economy grew just 0.2 per cent. The last time quarterly growth was lower than that was amid the lockdowns in September 2021. Additionally, annual growth of 1.5 per cent over the year to the December quarter is lower even than the annual growth amid the lockdowns of 2021.

Underpinning the most recent meagre GDP growth was an improvement in net exports. But this time that wasn’t caused by booming commodity exports, instead it was about lower imports. More of an automatic stabiliser than a sign of life.

With discretionary consumer spending collapsing, private investment falling and public expenditure mostly flat, there was little spark in the domestic economy. In short, economic growth is low and the trajectory is weakening. And that’s only considering things in aggregate terms. When we look at per capita terms, a recession is already in.

As the next chart shows, the last several quarters have featured falling economic output per person.

Australia’s population growth is keeping aggregate growth positive, which is propping up businesses that would otherwise be failing in a vacuum of weak spending. It is also maintaining upward pressure on property prices even though the domestic economy lacks energy.

What do we see?

Population growth is slowing but still remains very high, and the full effect of this will be felt over coming years.

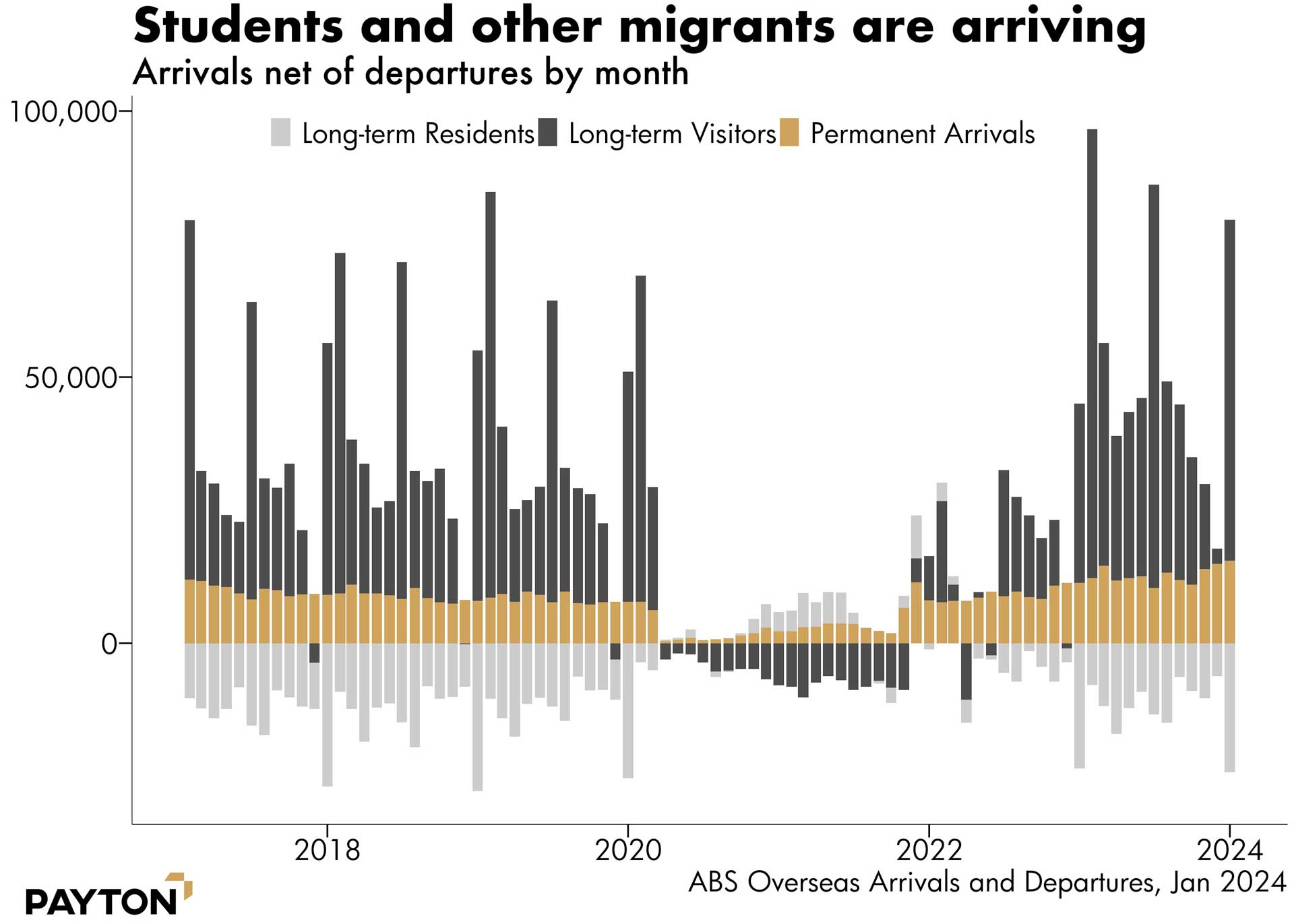

Official population data has numbers only up until the September quarter of 2023. But a more contemporaneous read on population growth can be obtained from the overseas arrivals and departures data.

It shows the peak of net long-term arrivals was January 2023. The most recent data is for January 2024 and it shows a lower peak in arrivals. Additionally, the usual December outflow in students didn’t happen – the black bar was positive even in December.

However, the outflow of Australians is picking up again as young people move back to London, San Francisco,Singapore and other typical overseas destinations post-pandemic.

Of course, migration is not the only part of the population picture. But it matters a lot. Natural increase in the Australian population is lower now than it was before the pandemic; births are flat and deaths are up. For this reason, population growth is very much driven by people who will be contributing directly and immediately to demand for rental properties, i.e. migrants rather than babies.

Arrivals from overseas are forecast to fall from 725,000 in 2022-23 to 660,000 in 2023-24 and then to 580,000 in 2024-25. Some of those arrivals are Australian citizens, but net Australian citizen arrivals are negative as Australians move abroad.

The biggest category of net arrivals is expected to be students, at more than 190,000 this financial year. After all the net movements, 380,000 more people are expected to be in Australia at the end of 2023-24 than were present at the start of the year.

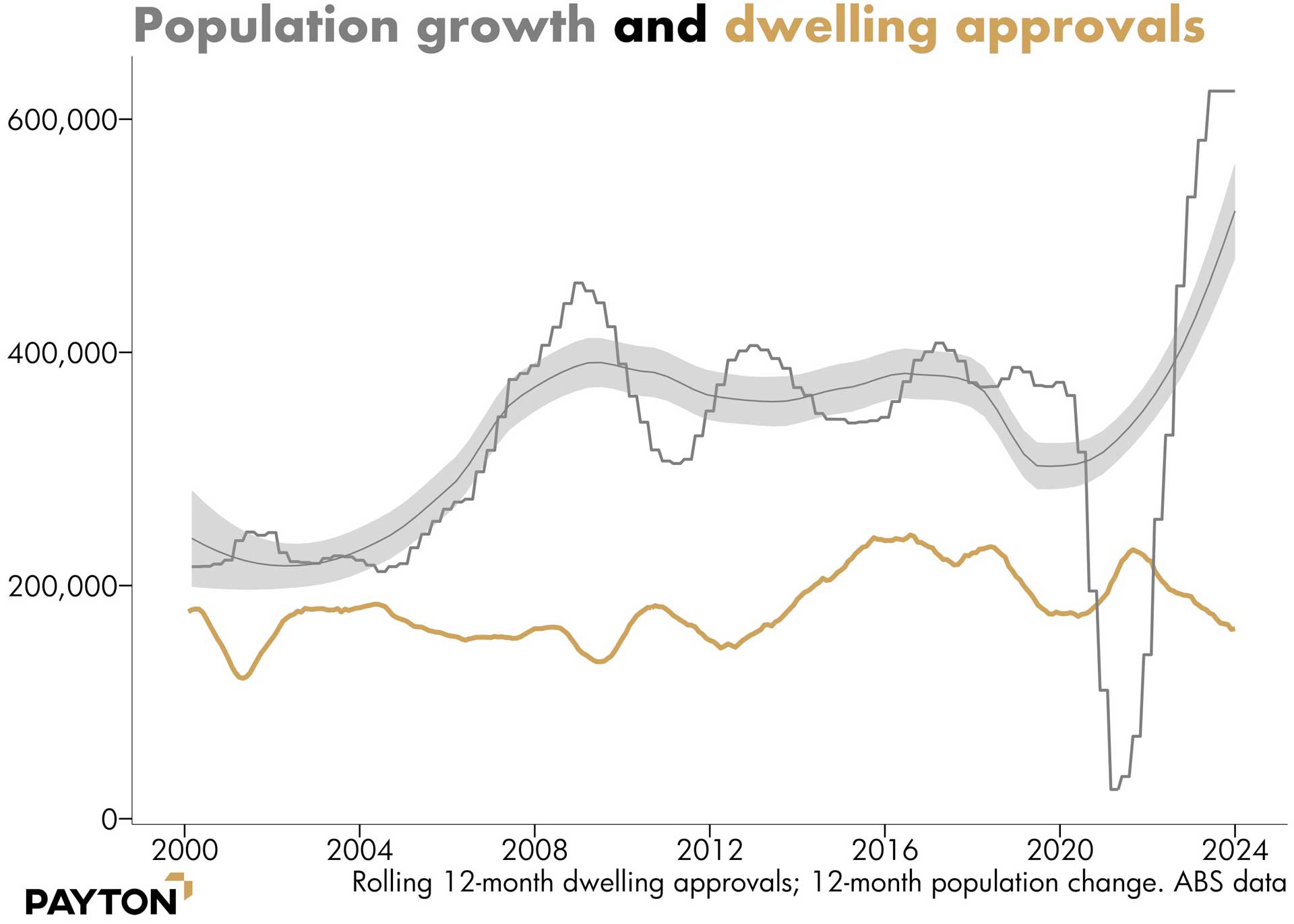

Nevertheless, the property sector shows little sign of getting ready for this influx. As the next chart shows, dwelling approvals are falling and the gap to population growth increasing.

And while many homes are being built, there has been a big lag in completions further adding to the undersupply in residential housing stock.

While the economy at large is sagging, the residential property market is underpinned by the strong fundamental demand for a place to live, which is meeting weak supply.

The strength of the property market can be measured in many places, including the rental market, borrowing and property prices.

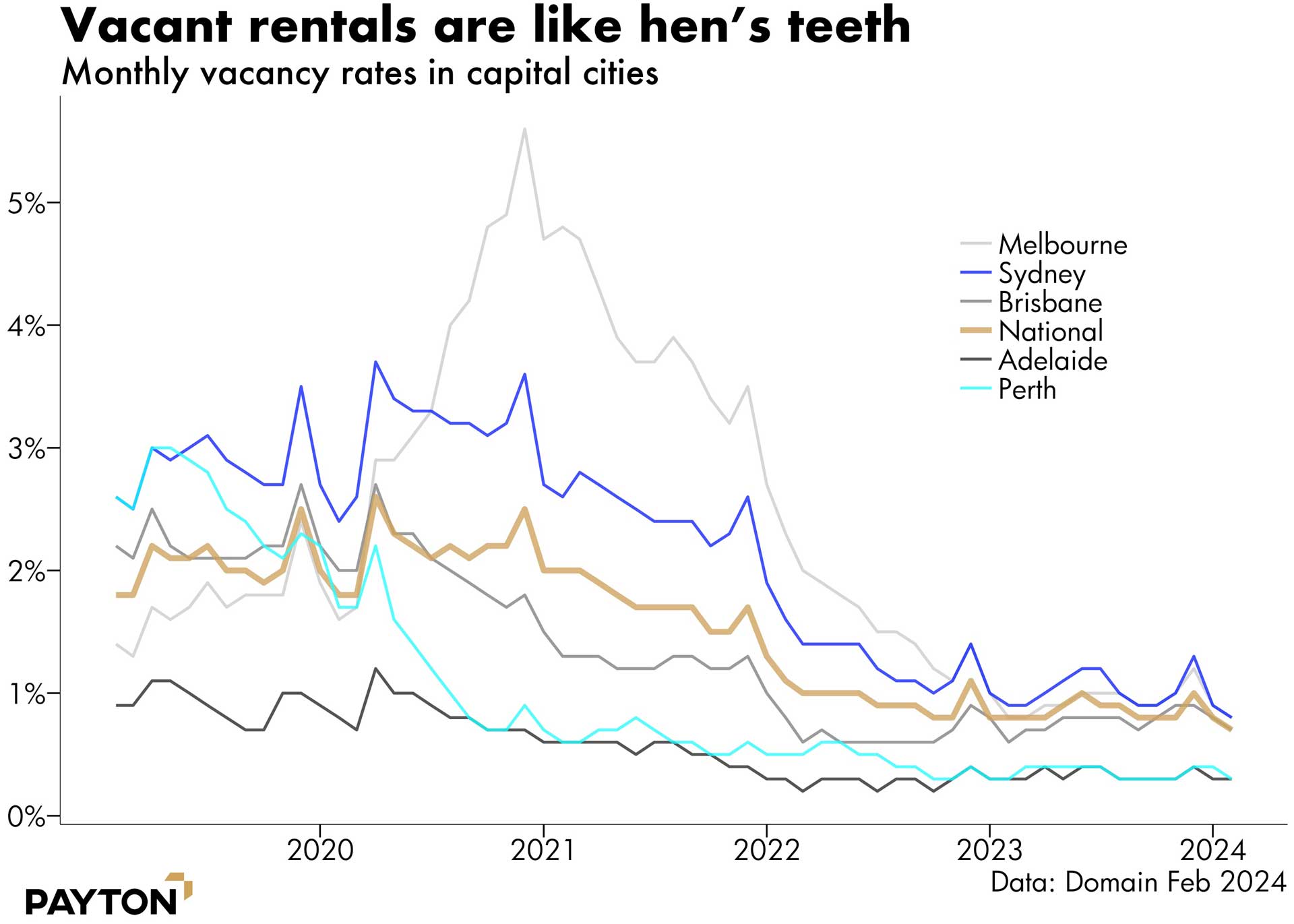

Rental vacancies in major capital cities were, in 2024, at their lowest levels on record, sitting at just under 1 per cent nationwide. Of the major capitals Sydney has the highest vacancy rate, at an extremely meagre 0.8 per cent, and it is falling. The rise in student numbers over coming years is likely to drive down rental vacancies in Melbourne and Sydney, two cities which are historically popular for overseas students.

Every city has rental vacancies well below their 2019 levels and prices which are generally above their 2019 levels. Corelogic data shows property prices are elevated nationwide, up 8.9 per cent over the last 12 months and up 10 per cent in capital cities. Perth, Adelaide and Brisbane are leading the pack as the next chart shows, with Hobart, Darwin, Canberra and Melbourne lagging.

House prices are expected to rise, albeit moderately in 2024. ANZ predicts a rise of 5 to 6 per cent in 2024 nationwide, with some cities doing better than others.

“Brisbane, Perth and Adelaide are likely to outperform other cities due to continued shortage of available homes. Housing prices are at new peaks in these cities and lending in their respective states has grown stronger than other states over recent months, particularly for investors,” wrote ANZ economists in a note to clients in late February.

Investor activity is likely to underpin the next stage of property market growth. Investor lending is up 18.5 per cent over the year to January while owner occupier lending is up 3.4 per cent. Higher rents make rental yields look good and the prospect of moderating interest rates dangles the possibility of even better yields in future.

Additionally, the bulk of population growth is skewed towards a group with a tendency to rent rather than buy meaning property investors will be sorely needed to accommodate the flow of population. That strength combined with expected rate cuts is why residential property markets are predicted to remain sound.

We believe that the demand drivers coupled with the structural undersupply will continue to drive positive outcomes across the residential property market. These same drivers can be found in some format across most sub-sectors of property, especially in commercial/industrial markets which will in turn lead to face rents increasing and cap rates starting to compress again. At Payton Capital, we have continued to focus on the residential sub sector as we believe that growth prospects underpin a future pipeline of quality risk adjusted returns for investors.

Disclaimer: The information contained in this document is of a general nature and does not take into consideration the investment objectives, financial circumstances or needs of any particular recipient – it contains general information only. The views expressed in this document are solely those of the author and are subject to change without notice. Any financial projection and other statements of anticipated future performance that are included in this document are for illustrative purposes only and are based on assumptions that are subject to risks and uncertainties and may prove to be incomplete or inaccurate. Actual results achieved may vary from the projections and the variations may be material. Before deciding to make an investment with Payton, you should carefully read all of the information in the relevant Fund Information Memorandum, and consult with your business adviser, financial planner, accountant or tax adviser. Reliance upon information in this document is at the sole discretion of the reader. Payton Capital Ltd is an authorised representative of Payton Funds Management Pty Ltd ABN 32 107 613 258 AFSL 284280

About the author

~~ News & Insights ~~

Payton Capital Quarterly Economic Update September 2024

By Craig Schloeffel|2024-10-01T16:44:22+10:00September 24, 2024|

Payton Capital Quarterly Economic Update June 2024

By Craig Schloeffel|2024-07-02T17:01:11+10:00June 21, 2024|

Payton Capital Announces Acquisition by ASX Listed HMC Capital

By Jodie Elg|2024-12-18T17:45:48+11:00May 24, 2024|

Payton Capital Quarterly Economic Update March 2024

By Craig Schloeffel|2024-07-02T17:07:49+10:00March 28, 2024|

Payton Capital Quarterly Economic Update December 2023

By Craig Schloeffel|2024-07-02T17:10:56+10:00December 15, 2023|

Media Release: Payton Capital’s Queensland Expansion

By Jodie Elg|2024-12-18T17:47:03+11:00October 20, 2023|

Payton Capital Quarterly Economic Update September 2023

By Craig Schloeffel|2024-07-02T17:14:08+10:00September 28, 2023|

Australia’s Housing Crisis is on the Verge of Imploding

By David Payton|2024-06-21T13:25:40+10:00July 4, 2023|

Payton Capital Economic Update June 2023

By Craig Schloeffel|2024-07-02T17:16:49+10:00June 30, 2023|

Foresight Analytics Upgrades Payton Capital’s Operational Due Diligence

By Jodie Elg|2024-12-18T17:47:04+11:00June 12, 2023|

Payton Capital Economic Update March 2023

By Craig Schloeffel|2024-07-02T17:20:11+10:00March 23, 2023|

Payton Capital Quarterly Economic Update December 2022

By Craig Schloeffel|2024-07-02T17:23:33+10:00December 12, 2022|