CEO Update: A confident end to the year

Dear Investors,

Confident end to the year …

Whilst most of us will be very happy to see the end of 2020, in the hope of a fresh start in 2021, it’s worth celebrating the fact that Australia is definitely bouncing back!

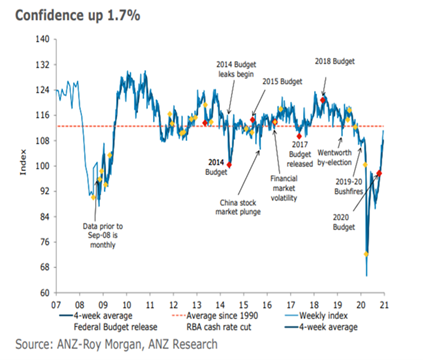

Consumer confidence continued to scale 2020 highs.

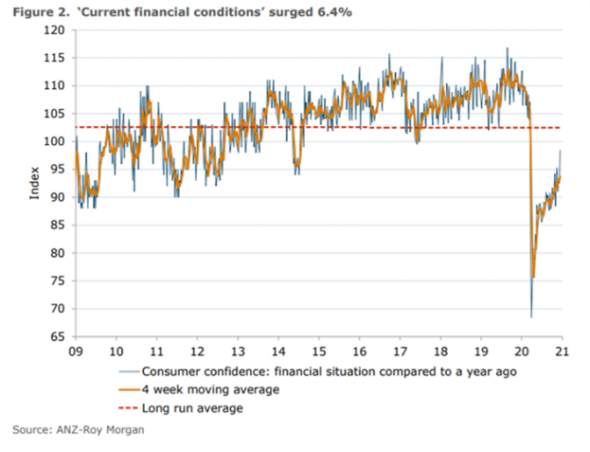

Current financial conditions surged 6.4%

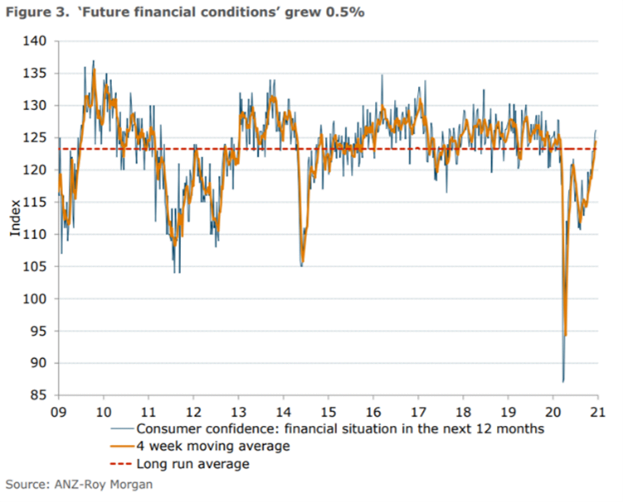

Future financial conditions grew 0.5%

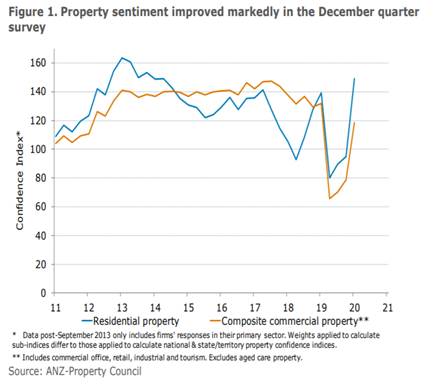

Property sector rose strongly this quarter

Latest data from ANZ Research depicted above shows that:

- Consumer confidence continued to scale 2020 highs. The overall index rose 1.7%, matching the prior week’s gain, with most of the sub-indices registering improvement.

- Current financial conditions surged 6.4%, while ‘future financial conditions’ grew 0.5%.

- Sentiment in the property sector rose strongly this quarter, and is essentially back to pre-pandemic levels.

- Confidence in both residential and commercial property rose, with confidence in the residential sector now at its highest level since 2015.

New Payton Pooled Fund offering in 2021

It’s with great pleasure that I announce the launch of a new investment fund in early 2021, the Payton Pooled Investment Fund. Our team has been working hard throughout this year to design a new fund that’s intended for investors who would prefer a more managed investment experience, with exposure to a carefully constructed portfolio of loans selected by Payton.Offering three new products, the Cash-Plus, Core and Opportunity Accounts will replace the current 48-Hour, 6-Month, and 12-Month offerings.

Whilst similar in many respects, the new products will have some distinct structural changes designed to further support the scalability of these investment products, so that we can continue to deliver premium, risk-adjusted returns across a variety of real estate debt investments.All investors will receive a copy of the new information memorandum in the new year, along with further information regarding what this means for you.

Your Relationship Manager will also reach out to you in January to discuss the new fund and the options available to you. For those investors that hold investments in the current 48-Hour, 6-Month and 12-Month Accounts,you will be invited to subscribe for units in the new fund, effectively converting your units in the Payton Select Investment Fund, to units in the Payton Pooled Investment Fund.In anticipation of the launch of the new pooled fund, Payton will be closing the current 6-Month and 12-Month accounts to any new investments from the 31st of January.

Importantly, for those investors that are invested in these products as of the 31st of January, Payton intends to honour the current income return and remaining term of the investment, until the investment matures (unless you elect to convert your investment into the new fund earlier). The Payton Select Investment Fund will continue to operate as a contributory mortgage fund only.

That is, investors who prefer to take a more active approach to their investments, and design their own portfolio, will still have the opportunity to do so.The Payton Pooled Investment Fund represents the culmination of a year’s worth of hard work, including improving the administrative infrastructure that supports our funds. Along with the new fund you’ll see new reporting functionality, a new website, and eventually an online client portal.

It also represents the continued growth and evolution of the Payton business, which is made possible by loyal clients such as you.

Welcome Pranav to the Team

Pranav Ramji has joined Payton Capital Corporate Finance team as a Senior Accountant. Pranav is skilled in Accounting, Audit, Financial modelling and reporting and holds a Masters of Management (Accounting and Finance) from the University of Melbourne.

Pranav was previously working as a Senior Analyst – Finance Managed Services at Deloitte.

Christmas is about Giving

At Payton we celebrate the ultimate gift of love at Christmas, as we give love and goodwill to family and friends and continue to be thankful for being in a position to give. For many however, Christmas is not an easy time whilst they navigate challenging family dynamics, financial distress, health conditions and memories of lost loved ones.

My challenge to all of us is to be alert to those around us that are struggling and to reach out in the ‘Spirit of Christmas’ this year, in a meaningful way.

If you need help to find worthy recipients,we are happy for you to join with us (thank you for all those who have already given) www.payton/foundation.com.au

Our offices will close on Wednesday 23rd December and reopen on Monday 11th January, 2021.

For any urgent queries or requests, you can message your Relationship Manager or contact Craig Schloeffel on 0417 391 454.

Happy holidays,

David J Payton

CEO

About the author / David Payton

~~ Related Posts ~~

Payton Capital Quarterly Economic Update March 2024

By Craig Schloeffel|2024-03-28T17:00:25+11:00March 28, 2024|

Payton Capital Quarterly Economic Update December 2023

By Craig Schloeffel|2023-12-15T12:16:58+11:00December 15, 2023|

Media Release: Payton Capital’s Queensland Expansion

By Jodie Elg|2024-01-25T11:28:11+11:00October 20, 2023|

Payton Capital Quarterly Economic Update September 2023

By Craig Schloeffel|2023-09-28T16:51:27+10:00September 28, 2023|

Payton Capital announce Chief Risk Officer Appointment

By David Payton|2023-10-20T14:46:25+11:00September 25, 2023|

Australia’s Housing Crisis is on the Verge of Imploding

By David Payton|2023-08-17T15:47:33+10:00July 4, 2023|

Payton Capital Economic Update June 2023

By Craig Schloeffel|2023-07-03T14:19:54+10:00June 30, 2023|

Foresight Analytics Upgrades Payton Capital’s Operational Due Diligence

By Jodie Elg|2023-09-19T17:41:20+10:00June 12, 2023|

Payton Capital Economic Update March 2023

By Craig Schloeffel|2023-07-04T14:40:08+10:00March 23, 2023|

Economic Update December 2022

By Craig Schloeffel|2023-08-18T14:01:07+10:00December 12, 2022|

Economic Update September 2022

By Jodie Elg|2023-09-18T18:39:37+10:00September 6, 2022|

Foresight Analytics rates Payton Capital Funds as STRONG

By Jodie Elg|2023-08-17T16:46:59+10:00June 17, 2022|