Australian Economic Snapshot

A Story of Growth

By Craig Schloeffel, Head of Investment

AAA Credit – 1 of 9

Australia is 1 of only 9 countries to maintain its Fitch Ratings AAA credit rating during the COVID 19 Pandemic. The ratings agency said Australia’s economy had weathered the pandemic well compared with its peers and estimated that GDP contracted by 1.1 per cent in 2020, against a “AAA” median contraction of 3.8 per cent.

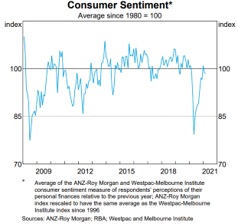

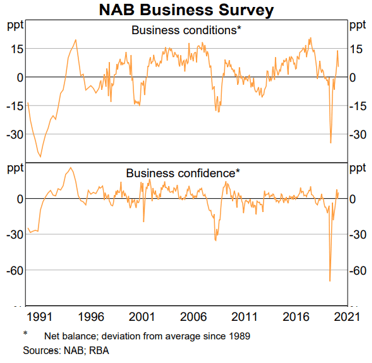

Confidence – 11 Year High

As Australia continues to show an ability to control the COVID impact and consumers see that the economic conditions are better than expected, consumer confidence continues to rise and has surpassed the pre-pandemic levels. This in turn has led to business confidence hitting an 11 year high.

As Australia continues to show an ability to control the COVID impact and consumers see that the economic conditions are better than expected, consumer confidence continues to rise and has surpassed the pre-pandemic levels. This in turn has led to business confidence hitting an 11 year high.

In turn we are seeing business indicators pointing to expansion in spending and investment which should flow through to continued unemployment data improvements.

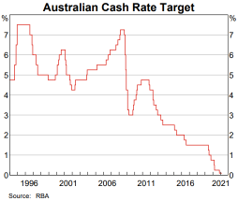

Cash rate – 0.1%

Interest rates are at historical lows with the RBA cash rate at 0.1%. The Reserve Bank of Australia (RBA) maintains that the cash rate will hold steady and its bond purchase programs continuing as is.

The RBA echoed other central banks’ willingness to do more if required and that a hike in the cash rate was at least a few years away.

Lending

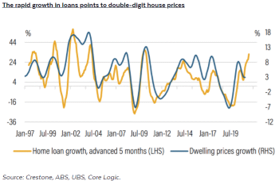

Recent months have seen clear signs of an acceleration in the housing market led by home lending. New lending (a key driver of price growth) has risen significantly, up by 59% since its May 2020 trough (to be 30% higher than a year ago).

Recent months have seen clear signs of an acceleration in the housing market led by home lending. New lending (a key driver of price growth) has risen significantly, up by 59% since its May 2020 trough (to be 30% higher than a year ago).

A separate Australian Bureau of Statistics report showed new home loans to investors jumped 9.4 per cent in January, the biggest gain in more than four years. Coupled with the relaxation in Responsible Lending Guidelines, we expect to see the rise in lending continue.

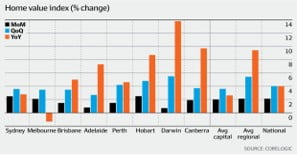

Property Growth – 4% YoY Increase

Recent months have seen clear signs of an acceleration in the housing market led by home lending. New lending (a key driver of price growth) has risen significantly, up by 59% since its May 2020 trough (to be 30% higher than a year ago).

A separate Australian Bureau of Statistics report showed new home loans to investors jumped 9.4 per cent in January, the biggest gain in more than four years. Coupled with the relaxation in Responsible Lending Guidelines, we expect to see the rise in lending continue.

Economic Growth – 3.1%

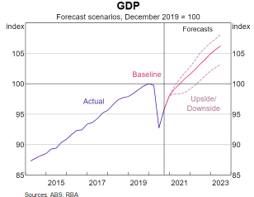

GDP for 2020 was down just 1.1% despite the pandemic, with the final quarter’s reading of 3.1% growth smashing expectations for 2.5%. Looking to the future, activity indicators remain strong and signal a continuation of the rebound. It is predicted that we will have robust growth beyond the 2021 year as consumers continue to gain confidence and spend.

Inflation – 0.9%

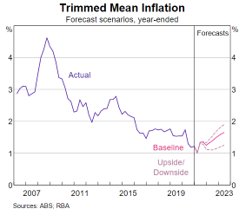

Australia has managed to keep inflation in check despite strong growth and recovery in GDP.

The RBA predicts that Inflation will remain subdued through 2022 and 2023 as we continue to recover, meaning interest rates are expected to remain lower for longer. This will give the government confidence to utilize any stimulus measures needed to maintain the economic recovery.

Population – 26M | 1.3% Annual Growth

Whilst we have seen a sharp drop in population growth due to the Australian Government halting immigration, there has been a lot of Australians returning home. As we emerge out of COVID and the international borders reopen, immigration will be a key focus for the Government to stimulate demand and ensure future growth.

About the author / Craig Schloeffel

~~ Related Posts ~~

Payton Capital Quarterly Economic Update March 2024

By Craig Schloeffel|2024-03-28T17:00:25+11:00March 28, 2024|

Payton Capital Quarterly Economic Update December 2023

By Craig Schloeffel|2023-12-15T12:16:58+11:00December 15, 2023|

Media Release: Payton Capital’s Queensland Expansion

By Jodie Elg|2024-01-25T11:28:11+11:00October 20, 2023|

Payton Capital Quarterly Economic Update September 2023

By Craig Schloeffel|2023-09-28T16:51:27+10:00September 28, 2023|

Payton Capital announce Chief Risk Officer Appointment

By David Payton|2023-10-20T14:46:25+11:00September 25, 2023|

Australia’s Housing Crisis is on the Verge of Imploding

By David Payton|2023-08-17T15:47:33+10:00July 4, 2023|

Payton Capital Economic Update June 2023

By Craig Schloeffel|2023-07-03T14:19:54+10:00June 30, 2023|

Foresight Analytics Upgrades Payton Capital’s Operational Due Diligence

By Jodie Elg|2023-09-19T17:41:20+10:00June 12, 2023|

Payton Capital Economic Update March 2023

By Craig Schloeffel|2023-07-04T14:40:08+10:00March 23, 2023|

Economic Update December 2022

By Craig Schloeffel|2023-08-18T14:01:07+10:00December 12, 2022|

Economic Update September 2022

By Jodie Elg|2023-09-18T18:39:37+10:00September 6, 2022|

Foresight Analytics rates Payton Capital Funds as STRONG

By Jodie Elg|2023-08-17T16:46:59+10:00June 17, 2022|